The client's perspective: Assessing the impact of IR35 reforms in the private sector

This report assesses the impact of the off-payroll working reforms on clients by assessing how engagements and IR35 determinations have changed.

Executive Summary

- Almost half of clients (49%) reported that their business could not achieve the same outcomes without the use of contractors

- Over a quater of clients (28%) have decreased the number of contracts they’ve given to contractors since the IR35 reforms

- 48 per cent of clients did not know the percentage of contractor engagements that were inside or outside IR35 at their company

Despite half of UK businesses (49%) stating that they could not achieve their level of growth and outcomes without the help of contractors, a significant number of companies (28%) have decreased the number of contracts they have given to contractors since the reforms to IR35 in April 2021. Moreover, over a third of clients (35%) agreed that it had been more difficult to attract the freelance talent that their business needs as a result of the IR35 changes, with 11 per cent strongly agreeing.

IR35 legislation in practice

With the one-year anniversary of IR35 fast approaching, it clear that the reforms have not only financially hit contractors – with over a third of contractors (35%) leaving self-employment as a result [1] – but have also created significant financial and administrative problems for clients. In fact, almost one in two clients (47%) reported that IR35 compliance had been a significant administrative burden to them over the past year. What’s more, the reform is so difficult to understand that almost 48 per cent of clients did not know the percentage of contractor engagements that were inside or outside IR35 at their company.

Whilst the reforms state that companies need to assess a contractor's employment status on an individual basis, one in five clients (20%) have made a blanket assessment and determined that all their contractors are within IR35.

In terms of carrying out an IR35 assessment for current engagements, over a quarter of clients (26%) say that they use the government’s CEST (Check Employment Status for Tax) tool whilst over one-fifth of businesses (22%) stated that they make IR35 assessments themselves without using any tools or software. Of those that use CEST, the research found that it had led to a 35 per cent decrease in contractor engagement and was also revealed by HMRC’s own statistics to be unable to make a determination in more than one in five (21%) cases. [2]

Introduction

The off-payroll working reforms (IR35) were implemented in the private sector on 6 April 2021 and shifted the responsibility for determining the employment status of freelancers/contractors to the end-clients for medium and large sized private business clients.

Originally planned to be introduced in the private sector in April 2020, the implementation was delayed by a year due to the pandemic.

We already know from previous research that over a third of freelancers (35%) have left self-employment since the implementation of the changes to IR35 whilst of those who remain, over a third (34%) are now operating through umbrella companies. [3]

The shift in responsibility for determining a contractor’s IR35 status has also changed how clients engage with contractors, with one in five freelancers (21%) reporting that their client had blanket assessed all their engagements and 11 per cent reporting that their client had introduced a blanket ban on those operating through a limited company.

Freelancers are now reporting that clients in major industries such as IT, financial services, construction, automotive and oil & gas have shifted how they engage with contractors as a result of the reforms. [4]

Building on our research from the perspective of freelancers in 2021 and HMRC’s own research on the impact of IR35 which surveyed just 34 employment agencies5, this research will seek to understand the impact of the reforms on clients.

This report will assess the impact of the off-payroll working reforms on clients by assessing how engagements and IR35 determinations have changed over the last 12 months whilst evaluating the implications of IR35 compliance for clients. The report also explores the intentions of clients regarding contractor engagement for the next 12 months and for the foreseeable future.

The last 12 months

In order to assess the impact of the reforms in the private sector, we asked clients how they have engaged contractors over the last 12 months and whether their overall use of contractors has changed since the implementation of the reforms.

Encouragingly, over a quarter of clients (26%) reported that the number of contractors they engage had increased in the past 12 months, despite the imposition of IR35 reforms in April 2021.

However, 28 per cent of clients reported that the number of contractors they engage had decreased over the last year, with 10 per cent reporting a significant decrease.

A further 39 per cent of clients reported that the number of contractors they engage had neither increased nor decreased in the past year.

Clients with more than 1000 employees (32%) were more likely to report that the number of contractors they engage had decreased over the last year than those with less than 1000 employees (23%). This closely aligns with reports from freelancers operating with major clients in industries such as IT, finance and construction – where large companies have introduced blanket assessments, deeming all contracts as within IR35 or blanket bans on hiring those operating through limited companies. [6]

Although clients have continued to engage contractors over the last 12 months, with a quarter actually increasing their engagement of contractors, it is also evident that the changes to IR35 in the private sector have led to some clients, particularly larger companies, reducing their engagement of contractors.

Engagement of contractors by clients over the last 12 months

Determining IR35 status

Prior to the reforms, almost a quarter (24%) of freelancers reported that their clients were planning to determine all engagements as inside IR35 whilst a further 19 per cent reported that their clients intended to use the CEST (Check Employment Status for Tax) tool to make the IR35 assessments. [7]

Looking at the current situation, 45 per cent of clients indicated that they provide individual assessments for every contractor engagement.

One fifth of clients (20%) reported that, as a result of the IR35 reforms, they have determined all contractor engagements to be within IR35 – a blanket assessment. This echoes previous IPSE research whereby 21 per cent of freelancers reported that their client had determined all engagements as inside IR35. [8]

Concerningly, seven per cent of clients stated that they have moved all contractors on to a payroll without assessing the IR35 status of the engagement – a blanket ban.

How has your company assessed IR35 status since April 2021?

In terms of carrying out an IR35 assessment for current engagements, over a quarter of clients (26%) reported that they use the CEST tool whilst over one-fifth of clients (22%) stated that they make IR35 assessments themselves without using any tools or software.

A further 17 per cent of clients reported that they use a third-party company to assess individual IR35 statuses.

In addition, eight per cent of clients stated that they assessed the IR35 status of engagements using a tool or piece of software other than the CEST tool.

When looking at differences across business size, clients with less than 1000 employees (28%) were more likely to make an IR35 assessment themselves without using any tools or software than clients with more than 1000 employees (18%).

There was also little difference in the use of the CEST tool when looking across business size, with clients with more than 1000 employees (27%) only slightly more likely to adopt the CEST tool for determinations compared to clients with less than 1000 employees (25%).

Similarly, there was also little difference in the use of a third-party company to assess individual IR35 statuses, with 18 per cent of clients with less than 1000 employees adopting this assessment method compared to 16 per cent of clients with more than 1000 employees.

Interestingly, of those clients that reported that they had determined all engagements to be within IR35, 39 per cent reported an increase in their engagement of contractors over the last 12 months. This could perhaps be explained by multiple factors, including contractors completing assignments with pre-existing clients, freelancers in saturated markets being less able to secure outside IR35 roles and clients facing a greater administrative burden as a result of their diligence in assessing engagements individually.

Conversely, of those clients that reported that they made individual assessments for every engagement, 37 per cent reported a decrease in contractor engagement over the past year.

Of those clients that reported that they used the CEST tool, 35 per cent reported a decrease in contractor engagement – a damning indictment of the CEST tool when two government departments have already received tax bills totaling over £120 million for IR35 non-compliance when both departments adopted HMRC’s CEST tool.[9] In fact, HMRC’s own statistics revealed that the tool was unable to make a determination in 21 per cent of cases. [10]

In addition, of those clients that adopted a third-party company to assess engagements, 39 per cent actually reported an increase in contractor engagement over the last year.

How does your company carry out IR35 status determinations?

Percentages do not add up to 100% because respondents were able to select multiple responses

Current situation

In terms of current engagements, clients reported that one-third of engagements (33%) were inside of IR35 whilst 19 per cent of these engagements were outside of IR35.

Notably, 48 per cent of clients surveyed did not know the percentage of contractor engagements that were inside or outside IR35, likely linked to the sharp increase in outsourcing of the IR35 determination process.

Clients with less than 1000 employees were more likely to report that their current engagements were outside IR35 than clients with more than 1000 employees (25% compared to 14% respectively).

Likewise, clients with more than 1000 employees (34%) were slightly more likely to report that their current engagements were inside IR35 than clients with less than 1000 employees (31%).

Perhaps unsurprisingly, clients with more than 1000 employees were more likely to report that they did not know the percentage of contractor engagements that were inside or outside IR35 compared to clients with less than 1000 employees (52% compared to 44% respectively).

Clients that reported that their current engagements were inside IR35 were more likely to report a decrease in overall contractor engagement in the past 12 months compared to those that reported that their current engagements were outside IR35 (35% compared to 27% respectively).

The implications of IR35 compliance

Almost half of all clients surveyed (47%) agreed that IR35 compliance had been an administrative burden since the introduction of the reforms, with 17 per cent strongly agreeing.

Clients with less than 1000 employees were more likely to agree that IR35 compliance had been an administrative burden since the reforms compared to clients with more than 1000 employees (50% compared to 45% respectively).

Just 11 per cent of all clients disagreed with the notion that IR35 compliance had been an administrative burden since the reforms.

‘Since the reforms, IR35 compliance has been an administrative burden’

Similarly, over a third (35%) of clients agreed that it had been more difficult to attract the freelance talent that their business needs as a result of the IR35 changes, with 11 per cent strongly agreeing.

On the other hand, 21 per cent of clients disagreed with the notion that it had been more difficult to attract the freelance talent that their business needs as a result of the IR35 changes.

Clients with more than 1000 employees were more likely to agree with the notion that it had been more difficult to attract freelance talent that their business needs as a result of the IR35 changes than clients with less than 1000 employees (37% compared to 32%).

Clients with less than 1000 employees were more likely to disagree compared to clients with more than 1000 employees (25% compared to 17% respectively).

‘It has been more difficult to attract the freelance talent our business needs as a result of the IR35 reforms’

Moreover, 42 per cent of clients agreed that the changes to IR35 have had financial implications for their business, with 13 per cent strongly agreeing.

Only 11 per cent of clients disagreed that the changes to IR35 have had financial implication for their business.

The financial implications on clients as a result of the reforms closely aligns with previous IPSE research which revealed the financial cost of the reforms to freelancers – with 80 per cent of those now working within IR35 reporting a decrease to their quarterly income as a result.[11]

‘The changes to IR35 have had financial implications for the business’

Payment method

Almost two-fifths of clients (37%) reported that they pay contractors into their own limited company.

A further 36 per cent of clients indicated that they pay contractors through their own payroll whilst 29 per cent reported that they pay contractors via an agency payroll.

Just 14 per cent of clients reported that they pay contractors via an umbrella company, which is slightly lower than previous IPSE research has revealed – whereby 34 per cent of freelancers reported that they were operating through an umbrella company since the implementation of the IR35 reforms in the private sector.[12]

Clients with less than 1000 employees were more likely to pay contractors directly into their own limited company compared to clients with more than 1000 employees (41% compared to 34% respectively).

However, clients with more than 1000 employees were more likely to pay contractors via an agency payroll compared to clients with less than 1000 employees (34% compared to 21% respectively).

How does your company pay the contractors that they are currently working with?

In addition, in order to understand the impact of IR35 compliance, we asked clients whether they have increased the number of Statement of Work contracts to help with IR35 compliance.

Statement of Work contracts are used to define the key deliverables required for an assignment to be considered complete and differ from a contract for service as it outlines responsibility for deliverables rather than just provision of the labour or service provided.

Since the introduction of the reforms in April, SoW contracts have been increasingly used as a way to continue operating outside of IR35 where clients have implemented blanket bans or blanket assessments.[13]

22 per cent of clients reported that the number of SoW contracts they issue had increased since the introduction of the reforms.

On the other hand, just under one-third (32%) of clients reported that the number of Statement of Work contracts they issue had not increased.

Attitudes towards contractor engagements

In order to understand the impact of the reforms on the attitudes of clients towards contractor engagements, we asked clients a series of statements around whether they see contractors as a valuable resource, changes in engagement of contractors in the long-term and on outcomes.

Notably, the majority of clients (76%) agreed that contractors are a valuable resource for their business, with 39 per cent strongly agreeing to the notion.

Just seven per cent of clients disagreed with the notion that contractors are a valuable resource for their business.

Interestingly, clients with more than 1000 employees were slightly more likely to report that contractors are a valuable resource compared to clients with less than 1000 employees (79% compared to 73% respectively).

‘Contractors are a valuable resource for the business’

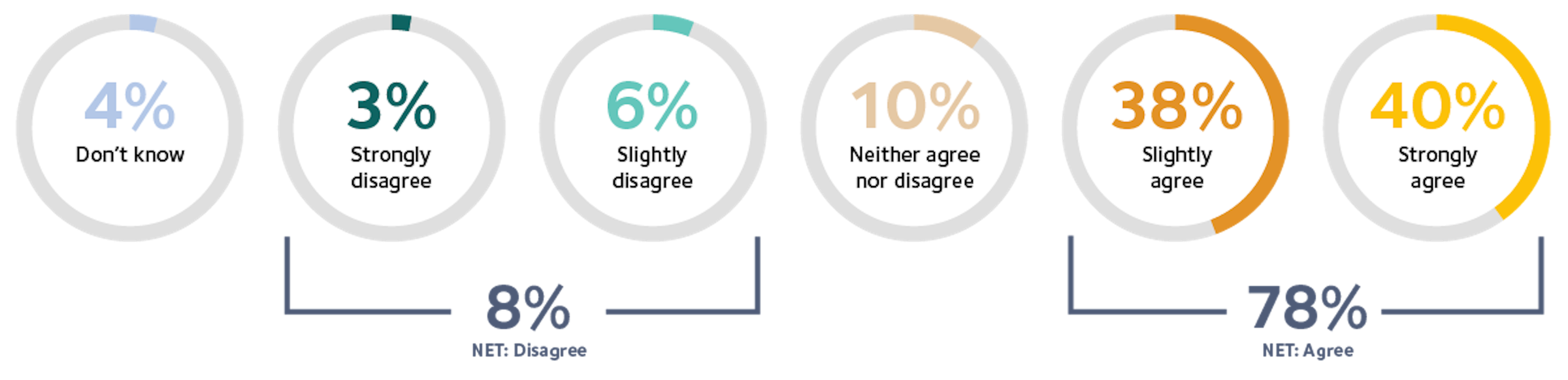

The majority of clients (78%) also reported that they plan to engage contractors for the foreseeable future, with 40 per cent strongly agreeing to the notion.

Only eight per cent of clients disagreed with the idea that they will continue to engage contractors for the foreseeable future.

Clients with more than 1000 employees were slightly more likely to report that their business will continue to engage with contractors for the foreseeable future compared to clients with less than 1000 employees (81% compared to 74% respectively).

‘The business will continue to engage contractors for the foreseeable future’

Almost half of clients (49%) also reported that their business could not achieve the same outcomes without the use of contractors, highlighting the important contribution that contractors continue to provide for clients across the UK.

On the other hand, 33 per cent of clients believed that their business could achieve the same outcomes without the use of contractors.

Clients with more than 1000 employees were slightly more likely to report that their business could not achieve the same outcomes without the use of contractors than clients with less than 1000 employees (53% compared to 44% respectively).

‘The business could achieve the same outcomes without the use of contractors’

Conclusion and recommendations

Whilst research into the impact of the reforms, over the past year, has mainly revealed the significant and damaging impact of the reforms on self-employed workers, this report clearly shows that the changes to off-payroll working in the private sector in April 2021 have also created substantial financial and administrative problems for their clients.

Freelancers are essential for long term growth, and therefore it is paramount that companies are able to access the expertise and support that self-employed workers provide. However, as shown by our research, the changes to IR35 last year have given clients the administrative burden of making notoriously difficult employment tax status decisions. This has made it harder for them to hire contractors and has made it even more difficult for them to grow.

With the pandemic continuing to loom large over the UK economy, it is essential that the burden of IR35 is lifted and that companies are able to hire freelancers to take advantage of the post COVID recovery.

The government must follow through on its rhetoric around supporting businesses in the aftermath of pandemic by rethinking IR35 now. Clients will otherwise find they aren’t able to hire the necessary skills and talent that freelancers provide and potentially recover at a slower pace compared to international competitors.

Recommendations

1. Clients should consider the use of independent IR35 assessment methods when engaging contractors. Uncertainty over IR35 status can delay the hiring of external contractors and throw projects off schedule. With HMRC’s own figures confirming that CEST fails to make an IR35 determination for one in five assessments, hiring businesses should consider the use of alternative assessment methods in the private sector, which are already being utilised by a quarter (25%) of hirers.

2. Government should end delays to its implementation of the Good Work Plan and proceed with work to align tax and employment status, as set out in the Taylor Review. This report reiterates the value that contractors provide to clients, particularly the UK’s largest businesses. But with many businesses still relying on blanket determinations, contracting bans, and many others being unsure how their contractors are assessed – there is an urgent need for government to simplify the rules. Updating employment legislation for the modern economy will create clearer expectations of when it is appropriate to operate as a limited company, a sole trader, or an employee.

3. Government should review the impact of the off-payroll working (IR35) reforms in both the private and public sector. Beyond testing whether the reforms have met government’s objectives, this review should measure the impact on contractors’ earnings and the recruitment environment, as well as the administrative impact on hiring businesses and projects they typically delegate to contractors – including key national infrastructure projects. It should also account for the reforms’ role in the significant expansion of the umbrella company sector and the public policy implications of a growth in this form of employment.

4. If IR35 remains in place, it should extend beyond tax to include employment status. When a contractor is placed inside IR35, their status is that of employment for tax purposes – yet they typically do not receive any of the tangible benefits of employment. A fairer system would see contractors directly employed by clients for the duration of an engagement, rather than engaged through a third party, such as an umbrella company.

With recent IPSE research finding that 74 per cent of freelancers are dissatisfied with their umbrella company, clients may want to consider how their relationship with freelance talent could be impacted by regularly engaging workers through a third party.

Appendix

Latest news & opinions

IPSE's Josh Toovey explains why 2026 could bring renewed opportunity for the self-employed after a tough 2025 of limited projects and rising costs.

The festive season is a chance to celebrate another year of hard work, thank clients and colleagues, and relax after filing your tax returns for the last financia...

If you’re running a business, the festive season is often a busy time with client projects to finish, tax returns to submit, and plans to make for the following y...