Executive Summary

- Two in five contractors (43%) have seen a decline in demand since the Autumn Budget

- A quarter (24%) plan to seek contracts abroad within the next year

- Almost seven in 10 (67%) feel less confident about securing outside IR35 roles

The freelance jobs market cooled in the three months following the October Budget, with over two in five contractors (43%) reporting that demand for their services had fallen compared to just 16 per cent that said it had increased.

The research also reveals that more freelancers are out of work, with over in five contractors (21%) reporting that they are not currently working, up from 18 per cent last year.

Notably, more than half (56%) of those not currently working cited the impact of the IR35 reforms on clients’ hiring plans.

The number of engagements determined to be on an outside IR35 basis has also fallen compared to our previous two reports, with seven in 10 (70%) of all engagements now determined in this way compared to 80% in both 2024 and 2023.

Additionally, just 22 per cent of contractors now intend to work as a contractor regardless of their IR35 status, reducing the pool of contractors that are willing to engage with a client on an inside-IR35 basis.

Introduction

Three years after the introduction of the off-payroll working reforms in the private sector, the self-employed sector continues to grapple with their impact. Produced annually, this report tracks key metrics related to IR35, including the determination process, the provision of a Status Determination Statement (SDS), and how contractors are now operating – whether via a limited company, umbrella company, or on the agency or client’s payroll.

The research from 2024 revealed that one in 10 contractors (10%) that were out of work attributed that to the IR35 reforms whilst almost a quarter (24%) were planning to seek contracts abroad.1

This report for 2025 will follow-up on the reports from 2023 and 2024 and track any changes in the way that clients are engaging contractors and any changes in the way that contractors are now operating.

To achieve this, we surveyed 1,039 contractors, asking them about IR35, changes in overall demand for their services in the past quarter, and their confidence in securing engagements for the next year.

Work status

To understand the current working status of contractors, we asked respondents whether they are currently working and for those not currently working, the reasons behind this.

Concerningly, our research now finds that contractors are increasingly out of work. Overall, 74% of freelancers are currently working, while 26% are not. The percentage of contractors in work has now fallen compared to our reports from 2024 (79%) and 2023 (82%) while the percentage of contractors out of work has increased (21% in 2024 and 18% in 2023).

When looking at the breakdown by age, those aged 50 years and over were more likely to be not working (29%) compared to those aged 16-49 years (16%). Concerningly, both age groups are now more likely to be not working compared to our findings in both 2024 (22% and 14% respectively) and 2023 (21% and 8% respectively).

The number of contractors currently out of work aged 50 and above has increased by seven percentage points in the past year.

Notably, over half of those not currently working (56%) reported that this was due to the impact of IR35 reforms in the private sector, representing a small increase on last year’s report (50%).

Almost half (45%) reported that they are currently in-between roles and have been in work over the past year, a small decrease on our findings from 2024, where over half of contractors (52%) reported this.

Other reasons given for not currently working included government policy towards the self-employed (33%), and not being incentivised to return to the labour market (15%).

Interestingly, almost seven in 10 of those that are currently retired (69%) reported that they would be open to return to the labour market.

The last 12 months

Looking at the engagements of contractors over the past year reveals that contractors have worked on an average of two engagements, exactly aligning with our findings from both 2024 and 2023.

Contractors continue to largely operate on engagements with private sector clients, with 81 per cent of all engagements based in the private sector. This again closely aligns with our research from 2024 (82%) and 2023 (82%).

Instead, 18 per cent of all engagements were with clients based in the public sector, representing a small decrease on our findings from 2024 (19%) and the same findings compared to our research from 2023 (18%).

Now looking at the IR35 status of engagements for non-exempt clients (where the off payroll working rules apply and the client has to make an IR35 determination) reveals that 54 per cent of all engagements were determined as outside IR35 while 46 per cent of engagements were determined as inside IR35.

Focusing only on the private sector reveals that the number of engagements deemed as outside IR35 has fallen compared to our previous reports.

Seven in ten (70%) of all engagements were on an outside IR35 basis (compared to 80% in both 2024 and 2023) while 30 per cent were determined as inside IR35 (compared to 20% in the previous two years).

A different picture was reported in the public sector, with the number of outside IR35 engagements actually increasing since last year.

Indeed, 88 per cent of all engagements in the public sector were on an outside IR35 basis (compared to 75% in both 2024 and 2023) while 12 per cent were on an inside IR35 basis (compared to 25% in the previous two years).

Interestingly, over half of contractors (53%) reported that they have rejected an offer of work in the past year solely because the client deemed the engagement to be inside IR35, which exactly matches our reports from both 2024 and 2023.

In addition, almost three in 10 of all engagements (27%) were with clients that were exempt from the IR35 rules, either because they were a small business or based abroad.

Current engagement

In order to track how the engagement of contractors has changed in the past year and since the introduction of the IR35 reforms, we asked respondents how they operate in their current engagement – or if operating on multiple roles, how they operate on the engagement that takes up most of their time.

Overall, almost three-fifths of contractors (58%) reported that they are being paid gross through their own limited company in their current engagement, which closely aligns with our findings from last year (60%) and 2023 (62%).

Almost three in ten (28%) now report that they are operating via an umbrella company, which also remains similar to our previous findings (30% and 27% respectively).

Similarly, three per cent are now working on an agency payroll whilst two per cent are now on a client’s payroll.

Current engagements for those contracting

Contractor demand

A new metric for 2025, we now ask contractors whether they’ve noticed any changes to their demand in the past three months in order to track any shifts in contractor demand related to government policymaking.

In particular, we were interested to track the impact of any changes announced at the Autumn Budget on how clients are now seeking to engage contractors.

In total, 43 per cent of contractors now report a decrease in demand for their services of the past three months while 41 per cent report it has remained the same and a further 16 per cent indicate that it has actually increased.

IR35 status

In order to track any changes in the determination of IR35 status over the past two years since the introduction of the reforms in the private sector, we asked contractors about the IR35 status of their current engagement or if operating on multiple roles, the IR35 status of the engagement that takes up most of their time.

Looking at the IR35 status of contractors’ current engagements reveals that contractors are increasingly operating on an inside IR35 basis in their current engagement compared to previous years.

In fact, 42 per cent are currently deemed as outside IR35 (compared to 47% in 2024 and 45% in 2023). Instead, 35 per cent are deemed as inside IR35 (compared to 29% in 2024 and 29% in 2023).

Interestingly, eight per cent of contractors indicated that the end-client had not discussed IR35 with them. This could be due to the fact that their client is exempt from the rules, or more concerningly, these clients may be unaware of their IR35 requirements or flouting their legal responsibilities to inform their contractors of an IR35 determination.

Overall, the research reveals that the market for outside and inside IR35 roles has remained relatively rigid over the past 12 months. Clients are increasingly moving away from their initial blanket approach to assessments and blanket bans on those working through a limited company, but many continue to be risk-averse in their approach to engaging flexible talent.

IR35 determination process

In order to track how clients are determining the IR35 determination process and to review any changes in these processes over the past 12 months, we asked contractors how their client determined the IR35 status for their current engagement.

Interestingly, clients were most likely to have used the CEST (Check Employment Status for Tax) tool, with 30 per cent of contractors indicating that their client adopted the tool to determine the IR35 status. Interestingly, this represents a decrease on our findings from both 2024 and 2023 (39% and 37% respectively).

A further 29 per cent of contractors reported that their client had used a third-party company to assess the IR35 status, which represents a small decrease on our findings from 2024 and 2023 (32% and 34% respectively).

One in ten contractors (10%) reported that their client used a tool or piece of software other than the CEST tool to determine the IR35 status of their engagement. This represents a small decrease on our findings from previous years, where 12 per cent of contractors reported this in both 2024 and 2023.

Another seven per cent of contractors reported that their client made the IR35 assessment themselves without using any tools or software. In comparison, six per cent of contractors reported this was the case in 2024 and nine per cent in 2023.

Concerningly, a further five per cent of respondents understand that their client has determined all engagements to be inside IR35 – a blanket assessment. This represents a sharp decrease on our findings from both 2024 and 2023 (13% and 11% respectively) and suggest that the prevalence of blanket assessments by clients – a form of non-compliance with the IR35 rules – has, encouragingly, decreased in the past year.

A further two per cent of respondents indicated that their client insisted they work on payroll without assessing the IR35 status of the engagement – a blanket ban.

How did your client determine your IR35 status?

Ways of working

Previous IPSE research how shown a notable rise in the use of umbrella companies since the introduction of the IR35 reforms in the private sector in 2021.3 In order to track the extent of this impact on contractors, we asked respondents whether they operate via an umbrella company, via their own limited company or whether they have been forced to close down their company since the introduction of the reforms.

Overall, 28 per cent of contractors are now operating via an umbrella company, which remains closely aligned with our previous findings for the previous two years (30% and 27% respectively).

Similarly, the number of contractors operating via their own limited company has remained relatively stable compared to our previous reports. However, we also know that many contractors have been forced to close down their limited companies since the introduction of the reforms.

Last year, for instance, almost two in five contractors had closed their limited company due to the introduction of the IR35 reforms in the private sector.4

That figure now stands at 20 per cent for 2025, a decrease that is likely attributable to the fact that these company directors are unlikely to now be responding to our survey.

In total, almost three-fifths of contractors (58%) now report that they are being paid gross through their own limited company in their current engagement, which closely aligns with our findings from last year (60%) and 2023 (62%).

Provision of a Status Determination Statement

Medium and large-sized businesses have been legally required since April 2021 to carry out the IR35 status determination and provide a Status Determination Statement (SDS) to all contractors.2

A SDS is usually a document or email that must be provided to the contractor for every contract that is agreed and based on the outcome of an IR35 assessment.

Despite this being a legal requirement for medium and large-sized businesses, nearly three-fifths of contractors (57%) indicated that their client had not provided them with a SDS in their current engagement. This closely aligns with our findings from both 2024 and 2023, where 63 per cent and 60 per cent of contractors had not been issued with one respectively.

Use of indemnity clauses

An indemnity clause is where contractors are asked or required to accept a contractual condition that they will indemnify fee-payers against HMRC tax investigations.

Despite not knowing if these clauses are legally enforceable, IPSE has been aware of clients using such clauses for outside IR35 engagements to cover against any retrospective HMRC investigation relating to IR35.

In order to track the prevalence of indemnity clauses in supply chains, we asked contractors whether one of their clients has ever asked or required them to agree to an indemnity clause as a contractual condition for an outside IR35 engagement.

Overall, over a quarter of contractors (28%) now report that they have been asked or required to agree to an indemnity clause, representing an increase on our reports from 2024 (23%) and 2023 (24%).

Of those that had been asked or required to accept an indemnity clause (28%), the overwhelming majority (80%) simply accepted the indemnity clause and signed the contract. For comparison, this figure stood at 76 per cent last year.

On the other hand, 20% indicated that they successfully negotiated the indemnity clause out of their contract, representing a small decrease on our findings from last year (26%) but a small increase on our findings from 2023 (18%).

The next 12 months

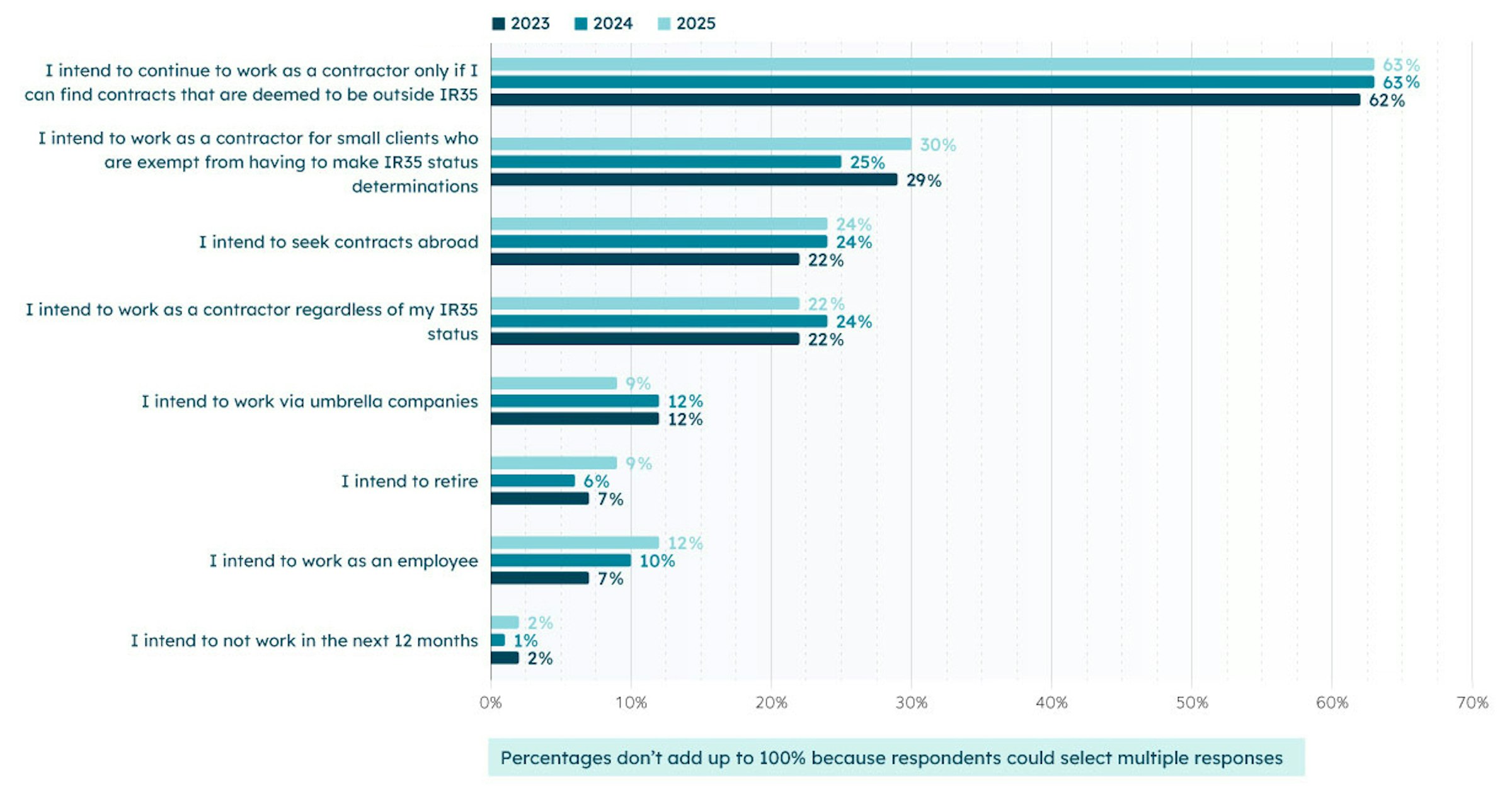

When asked about their intentions for the year ahead, over three-fifths of contractors (63%) reported that they intend to continue to work as a contractor only if they can find contracts that are deemed to be outside IR35. This exactly matches our research from 2024 and closely aligns with the findings from 2023 (62%).

Notably, almost a quarter of contractors (24%) intend to seek contracts abroad – reducing the pool of flexible talent available to UK businesses and boosting overseas economies at the expense of UK PLC. This is particularly concerning given that 24 and 22 per cent of contractors indicated that this was their intention over the past two years respectively.

Interestingly, one in three (30%) indicated that they intend to only work as a contractor for small clients who are exempt from making IR35 determinations which represents a small increase on our report from 2024 (25%) and a aligns with our findings from 2023 (29%).

Additionally, 22 per cent of contractors intend to work as a contractor regardless of their IR35 status.

Just nine per cent are planning to retire in the next year while 12 per cent intend to work as an employee and a further nine per cent anticipate working via an umbrella company.

The findings confirm for the third successive year that freelancers remain highly reluctant to take on inside-IR35 roles, and many will only continue contracting if they can secure outside-IR35 engagements.

How contractors intend to operate in the next 12 months

Confidence in the market

In order to measure overall confidence in the market, we asked those contractors that were seeking to only engage on an outside-IR35 basis (63%) how confident they were in securing outside IR35 engagements over the next year.

In total, just nine per cent of contractors were more confident in securing these roles in the coming 12 months compared to the previous 12 months.

Notably, almost seven in 10 (67%) contractors were less confident in securing these roles in the coming year.

A further 24 per cent were as confident in securing these roles as they had been in the previous 12 months.

Conclusion

These findings underscore the ongoing challenges faced by contractors in the wake of the IR35 reforms and broader economic conditions. Demand for freelance services has declined, and as has confidence in securing outside IR35 engagements in the coming year.

While some progress has been made in easing the nerves of clients, potentially due to the introduction of the offset mechanism, it is clear that many clients remain cautious in their approach to engaging flexible talent.

Looking ahead, the reluctance of contractors to accept inside IR35 roles poses a risk to the availability of highly skilled freelance talent in the UK.

With almost a quarter of contractors planning to seek work overseas and a significant proportion opting to work only for small clients exempt from IR35 obligations, businesses reliant on flexible expertise may struggle to secure the talent they need.

These findings highlight the critical need for the government to immediately commission a comprehensive review of IR35's impact across the entire supply chain. This review must be paired with strong, actionable measures to revitalize the UK’s vital contracting sector.

Latest news & opinions

IPSE's Joshua Toovey outlines the top five tax tips for the self-employed so you can get ahead of next year's tax year end.

Following a ruling that four sports broadcasters broke rules on coordinating their freelancers' pay, IPSE's Fred Hicks looks at the options for levelling the play...

IPSE's Joshua Toovey runs through the key announcements for the self-employed at the 2025 Spring Statement.