Counting the cost of the pandemic on self-employment

One year on from the onset of the pandemic, this report examines its impact on freelancers’ businesses and income whilst also reviewing their plans for the future.

The impact of the pandemic

Our previous assessment of the pandemic, at its onset, revealed that freelancers were suffering from a loss in income, an increase in stress levels and greater cashflow problems – ultimately leading to 19 per cent of businesses expecting to cease trading as a result of the pandemic.

IPSE’s Freelancer Confidence Index, a quarterly economic report of the sector, revealed business and economic confidence fell to record lows as a result of the pandemic with quarterly earnings falling sharply and spare capacity increasing. In fact, freelancers’ quarterly earnings dropped from £20,821 in Q1 2020 to £15,709 in Q2 2020 representing the lowest level on record.9 In addition, in Q2 2020 freelancers were only working on average 7.5 weeks out of a possible 13 – the lowest level on record - with demand for work remaining below pre-pandemic levels throughout 2020.

Research also suggests that freelancers have been more heavily impacted than their employed counterparts by the pandemic. In fact, at the height of the pandemic, 60 per cent of freelancers saw their income fall during April 2020 – compared with just 22 per cent of employees – with almost a quarter reporting having to use their savings to cover living costs.

Our most recent work now shows that the majority of freelancers (67%) report that the pandemic has had a negative impact on their freelance business with just one in ten (10%) reporting that the pandemic had had a positive impact and 22 per cent reporting no difference.

The negative impacts of the pandemic have been felt across the whole freelancing sector with very few differences between age, gender, occupation or business structure.

For many this negative impact has translated into a reduction in turnover with three in five freelancers (60%) stating that their turnover has decreased in the last 12 months, including 39 per cent reporting that their turnover had decreased a lot.

When asked to quantify the total reduction in turnover, concerningly, almost half of freelancers (47%) reported a decrease in turnover of greater than 40 per cent and almost one in ten (9%) reported a decrease in turnover of greater than 90 per cent – a devastating reduction.

The impact of reduced turnover is most notably illustrated with that fact that of those who stated that their turnover had decreased, the overwhelming majority (93%) reported that the pandemic had had a negative impact on their businesses.

Looking at the differences based on business structure, over three in five sole traders (62%) reported a decrease in turnover over the last 12 months compared with 55 per cent of limited company directors. Sole traders were also more likely to state that their turnover had decreased a lot (41%) compared to limited company directors (34%).

Although limited company directors were less likely to report a decrease in turnover compared to sole traders, the impact of the decrease seems to have been greater for limited company directors. In fact, 56 per cent of limited company directors reported that their turnover had decreased by 40 per cent or more compared to 46 per cent of sole traders. Furthermore, 15 per cent of limited company directors reported that this decrease had been over 90 per cent compared to eight per cent of sole traders.

There were also significant differences between genders with 43 per cent of male freelancers reporting that their turnover had decreased a lot compared to 36 per cent of female freelancers. In fact, over half (52%) of male freelancers had experienced a decrease of over 40 per cent in turnover compared to 43 per cent of female freelancers.

Significant differences were also seen between age groups, with freelancers aged 35 and over more likely to report that their turnover had decreased in the last year compared to those under 35 (62% compared to 50% respectively). Freelancers aged 35 and older were also more likely to report that the decrease in turnover had been over 40% compared to those under 35 (51% and 44% respectively).

On a more positive note, 19 per cent reported that their turnover had stayed about the same whilst 13 per cent of freelancers reported that their turnover had actually increased over the last 12 months.

For those reporting an increase in turnover, we see very little demographic difference in terms of age, gender, occupation and business structure.

Maintaining business success

In order to mitigate against the impact of the past year, freelancers have adopted various approaches in order to secure the survival of their freelance businesses and navigate through lockdowns and associated restrictions.

Since early April 2020 – the height of the pandemic’s initial impact – almost a third of freelancers (32%) reported that they had explored new business concepts whilst almost one in four have done training to expand existing skills (24%) or to learn new skills (22%).

Almost one in four freelancers (24%) also reported expanding their client base or expanding their business’ products and services (19%) in order to diversify their businesses.

Interestingly, women were significantly more likely than men to have done training to expand existing skills (28% compared to 21%) or to learn new skills (26% compared to 18%).

Concerningly, 15 per cent of freelancers reported that they had reduced day rates or fees as a result of the pandemic to secure work, which represents a slight increase from our findings in April – May 2020, whereby 9 per cent reported having to cut day rates. This highlights the increasing longevity of the pandemic’s impact on freelance businesses.

From this latest research, it is also evident that reducing day rates or fees is closely linked with experiencing a reduction in total turnover. For instance, 22 per cent of those who had suffered from a fall in turnover reported that they had been forced to reduce day rates or fees compared to 5 per cent of those who had seen an increase in turnover.

This trend in reducing day rates closely aligns with our previous findings on day rates throughout 2020, which fell to record low levels in Q2 2020 and have only recently returned to pre-pandemic levels in Q1 2021.

"Which, if any, of the following have you done in the last year (i.e. since early April 2020)?"

Government support

With three in five freelancers experiencing a reduction in turnover, many looked to government support in order to mitigate the financial impact of the pandemic.

Although the Self-Employed Income Support Scheme (SEISS) grant payments have offered support to over 3.4 million people, many groups of freelancers have been excluded from government support, for most of or all of the pandemic to date.14 These groups include newly self-employed people (those filling tax returns for 2018/19 and 2019/20 – although they are now included in the latest round of SEISS support), freelancers earning over £50,000 a year and, in particular, limited company directors – who remain unable to access economic support.

With many freelancers unable to access economic support from government despite suffering from a devastating decline in turnover, it is unsurprising that over half of freelancers (52%) now report that they do not feel supported by government. This includes over a third (31%) who take this further and report that they do not feel supported at all by the UK government.

On the other hand, a quarter of freelancers (25%) report that they feel supported by the government, however, just 3 per cent report that they feel very supported by the UK government.

It is probable that concerns expressed in IPSE’s latest Freelancer Confidence Index around government taxation policy – namely IR35 reforms and the impact on negotiating contracts – and gaps in government support during the pandemic, have contributed to the feeling that the government does not support the sector.15

Perhaps unsurprisingly, those who reported a decrease in turnover over the last 12 months were more likely not to feel supported by the UK government (54% compared to 46% of those who experienced an increase in turnover).

Looking at the differences by occupational grouping reveals that SOC3 associate professional and technical freelancers are more likely to feel supported by the government (29%) compared to SOC1 managerial freelancers (20%) and SOC2 professional freelancers (22%).16

Furthermore, over half (56%) of SOC1 managerial freelancers do not feel supported by the government whilst half (50%) of SOC2 professionals and SOC3 associate professional and technical freelancers feel supported.

Limited company directors (67%), in particular, report that they do not feel supported by the UK government compared with under half (48%) of sole traders. This includes 44 per cent of limited company directors who do not feel at all supported compared to 27 per cent of sole traders. Similarly, 28 per cent of sole traders report that they do feel supported by the government compared to just 12 per cent of limited company directors.

A devastating combination of being excluded from government support throughout the pandemic and the introduction of IR35 reforms in the private sector has undoubtedly contributed to the lack of support felt by limited company directors.

Looking to the future

The impact of the pandemic and the added damage from the IR35 reforms being introduced in the private sector together have had a devastating impact on the freelance sector. Given that many have lost income, struggled with mental health and received little or no support over the last year, we asked freelancers about their working plans going forward.

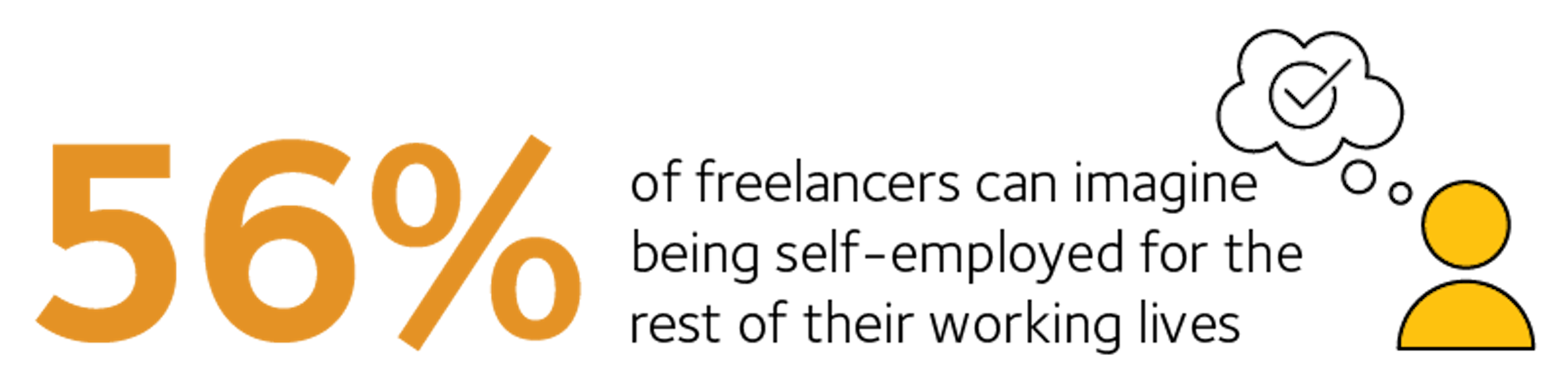

Encouragingly, over half (56%) of freelancers stated that they could imagine being self-employed for the rest of their working lives. This echoes previous research from before the pandemic where 57 per cent of freelancers could imagine being self-employed for the rest of their lives, in a large part because of the freedom and flexibility it provides.17

However, not all freelancers are planning to continue working in this way with 17 per cent stating they would consider working for someone if the opportunity arose and eight per cent actively seeking an alternative to self-employment. Furthermore, 14 per cent reported that whilst self-employment worked at the moment, they could imagine it could change in the future.

Looking at the differences in future plans between age groups reveals that those aged 45 and above were more likely to imagine themselves being self-employed for the rest of their working (65%) compared to those aged under 45 (43%).

Amongst occupational groups, SOC3 associate professional and technical freelancers were less likely to imagine themselves being self-employed for the rest of their working lives (51%) compared to SOC1 managerial freelancers (60%) and SOC2 professional freelancers (59%).

Additionally, one in five (20%) SOC3 associate professional and technical freelancers would consider working for someone else if the opportunity arose compared with 16 per cent of SOC1 managerial freelancers and 14 per cent of SOC2 professional freelancers.

Limited company directors were also slightly more likely to envisage themselves remaining in self-employment for the rest of their working lives (59%) compared to their sole trader counterparts (56%).

Sole traders were also slightly more likely to be considering working for someone else (18%) or actively seeking an alternative to self-employment (8%) than limited company directors (13 per cent and seven per cent respectively).

Perhaps unsurprisingly, those who had seen an increase in turnover during the pandemic (63%) were slightly more likely to want to stay in self-employment than those who had suffered from a turnover decrease (56%). Similarly, those who had seen a decrease in turnover were more likely to be actively seeking an alternative to self-employment (9%) than those who had seen an increase in turnover over the last 12 months (2%).

The top reason why some freelancers were thinking about leaving self-employment immediately or in the future was because they thought they thought they could earn more in employment (43%).

A total of 40 per cent were also considering an alternative in the future because they preferred the security of employment and 35 per cent cited access to employment rights as one of their reasons.

In addition, 30 per cent reported that they miss the workplace camaraderie and human interaction offered by employment whilst 29 per cent blamed the lack of support as a self-employed person during the pandemic as a contributing factor.

Although, 8 per cent indicated that they were planning to retire, 9 per cent reported that the consideration of alternatives was due to the changes to IR35 in the private sector. This figure rose to 30 per cent for limited company directors who are those most impacted by the changes to IR35 in the private sector.

Freelancers also express significant concerns about the current state of contracting, with 12 per cent saying that a factor in their decision to look for alternatives to self-employment was the fact they felt exploited by their current arrangement.

'Reasons for considering an alternative to self-employed'

Unsurprisingly, those who had suffered a decreased turnover over the last 12 months (34%) were more likely to cite the lack of government support for the self-employed during the pandemic as a reason for considering alternatives to self-employment, compared to those who had experienced an increase in turnover (21%).

Overall, it is clear that the lack of government support, the lack of employment rights and the imposition of IR35 reforms have all contributed to the increasing willingness of freelancers to consider alternatives to self-employment.

Conclusion & recommendations

The pandemic has inflicted significant and far-reaching financial damage on the self-employed sector, which, for many, has been severely exacerbated by the gaps in government support.

The damage was uneven across the sector and there were even some positive stories of freelancers building and improving their businesses during the pandemic. And there are lessons to be learned from these strategies for diversifying and adapting in difficult times.

Overwhelmingly, however, the pandemic has had a negative impact on the freelance sector, leading to long-term financial damage and many freelancers considering alternatives to self-employment. Some of the key motivators here seem to be long-term worries about the security of self-employment and an increased desire among freelancers for employee benefits such as sick pay.

The gaps in support have also led to many freelancers – particularly limited company directors who could not access SEISS – not feeling supported by the government. There is no doubt the fact that limited company directors are the group most adversely affected by the changes to IR35 self-employed taxation has also contributed to this.

There are many significant questions now hanging over the freelance sector: not least, how quickly – if at all – it can recover. Historically, there has generally been a surge in freelancing during economic downturns as employers look for flexible expertise to rebuild and diversify – and as they become risk-averse, seeking alternatives to permanent employees. This flexible support is one of the key functions of the freelance sector.

It is as yet uncertain, however, whether we will see this surge now both because of the extensive damage of the pandemic and also because of the structural changes to IR35 taxation. Data on the financial strength and size of the freelance sector over the coming months may give early indications.

The end of restrictions will not cure all the difficulties facing the self-employed today. Covid-19 has caused a cashflow crisis, with almost half of freelancers reporting a 40 per cent decline in turnover during the pandemic and almost one in ten seeing turnover reduce by more than 90 per cent. The self-employed need a cash boost to enable them to overcome the barriers preventing them from growing back after the devastation of Covid-19.

As part of a self-employed stimulus package, government should consider:

Appendix

IPSE’s Josh Toovey outlines why tens of thousands of sole traders risk being unprepared for Making Tax Digital for Income Tax in April 2026, with new research rev...

IPSE's Joe Woodhouse, one of our member-elected board members, updates us on where we are in the process of electing two new members to our board.

A summary of everything sole traders, freelancers and contractors need to know following the Budget statement.