What financial wellbeing looks like for the self-employed

This piece of research examines the key financial challenges the self-employed face and sets out recommendations to alleviate any long-term financial concerns among them.

Introduction

Money makes the world go round, as the saying goes. It is an indispensable commodity that most of us spend our whole lives working for, and it is also one of the most important determinants of a person’s quality of life. For the self-employed, financial wellbeing can be a particularly fraught issue. People who work for themselves on a project-by-project basis often have fluctuating incomes, which can make it difficult to access financial services and government benefits – let alone plan for the future.[1] Clearly, even though it is well-established that being your own boss can be extremely rewarding,[2] it is not without its challenges.

Beyond just giving you a little extra dough to enjoy life, financial circumstances can have a significant impact on your wellbeing and mental health. Research has shown that concerns about personal finances can have harmful effects on employees, including losing sleep because of worrying about money, finding it hard to concentrate and make decisions at work, spending time during the working day dealing with money issues, and even having health problems.[3]

Financial circumstances are likely to have a more significant impact on the wellbeing of self-employed people. Working for yourself exposes you to conditions known to generate higher levels of stress, not least because carrying the weight of your business succeeding or failing can be a solitary endeavour.

There is a lot to think about when you are self-employed. In fact, there are hundreds of extra decisions you have to make every day. So the last thing you need on top of all of that is worries about financial wellbeing. Really, self-employed people need a greater sense of financial wellbeing to lighten their mental load – so they can enjoy the freedom that should come with working for yourself.[4]

As self-employment in the UK continues to rise, there is growing concern that financial policies and services are out of touch with the realities of the modern labour market and potentially harming the financial wellbeing of the self-employed. To shed light on the situation, IPSE conducted a study exploring the financial wellbeing of the self-employed and what can be done to make this way of working sustainable, fulfilling and financially rewarding for them.

What does financial wellbeing look like for the self-employed?

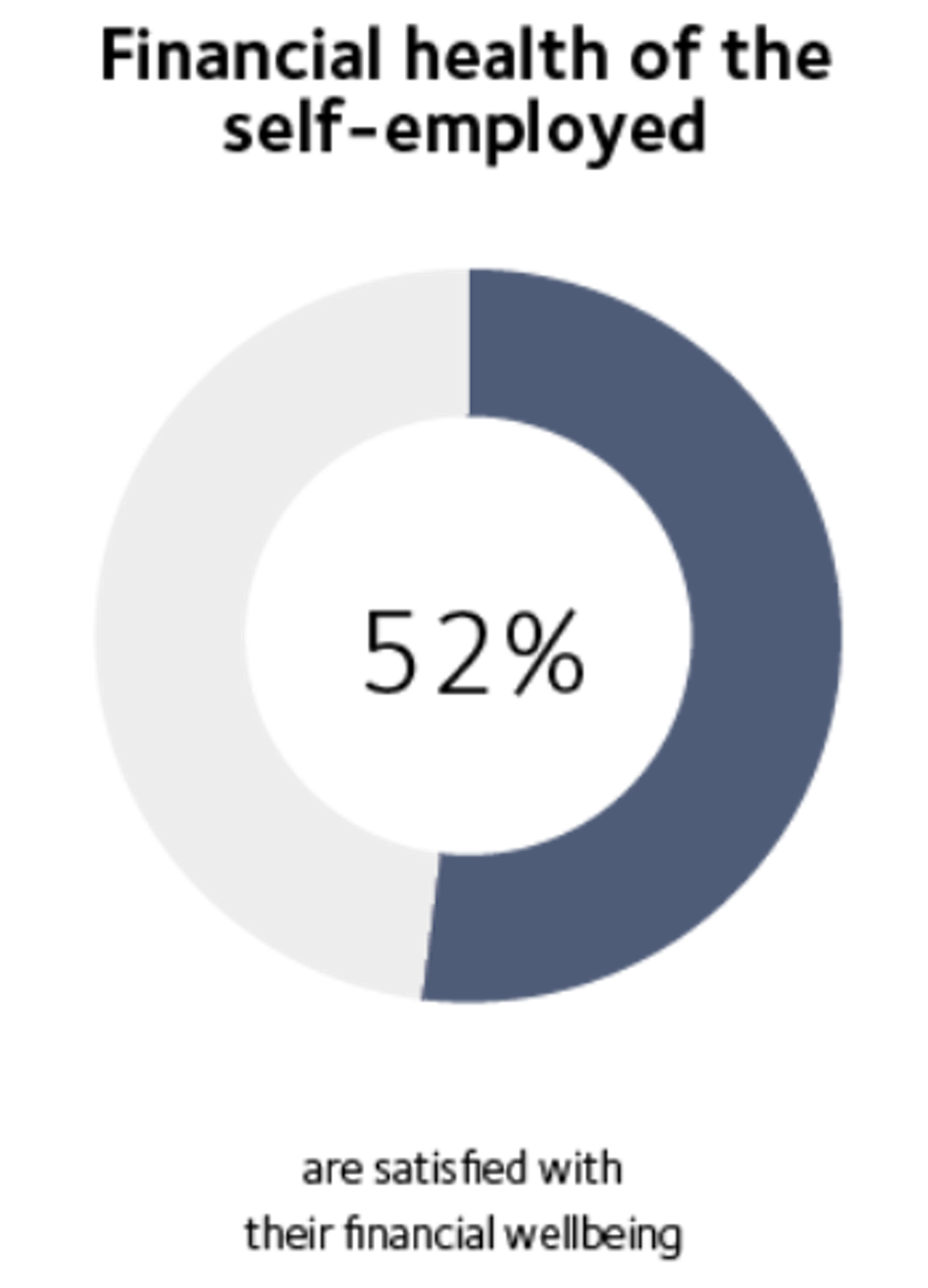

The economic health of the self-employed is divided, with just over half (52%) indicating that they are satisfied with their financial wellbeing. But what does financial wellbeing mean to the self-employed? Being able to support your family? Growing your business? Having a steady income?

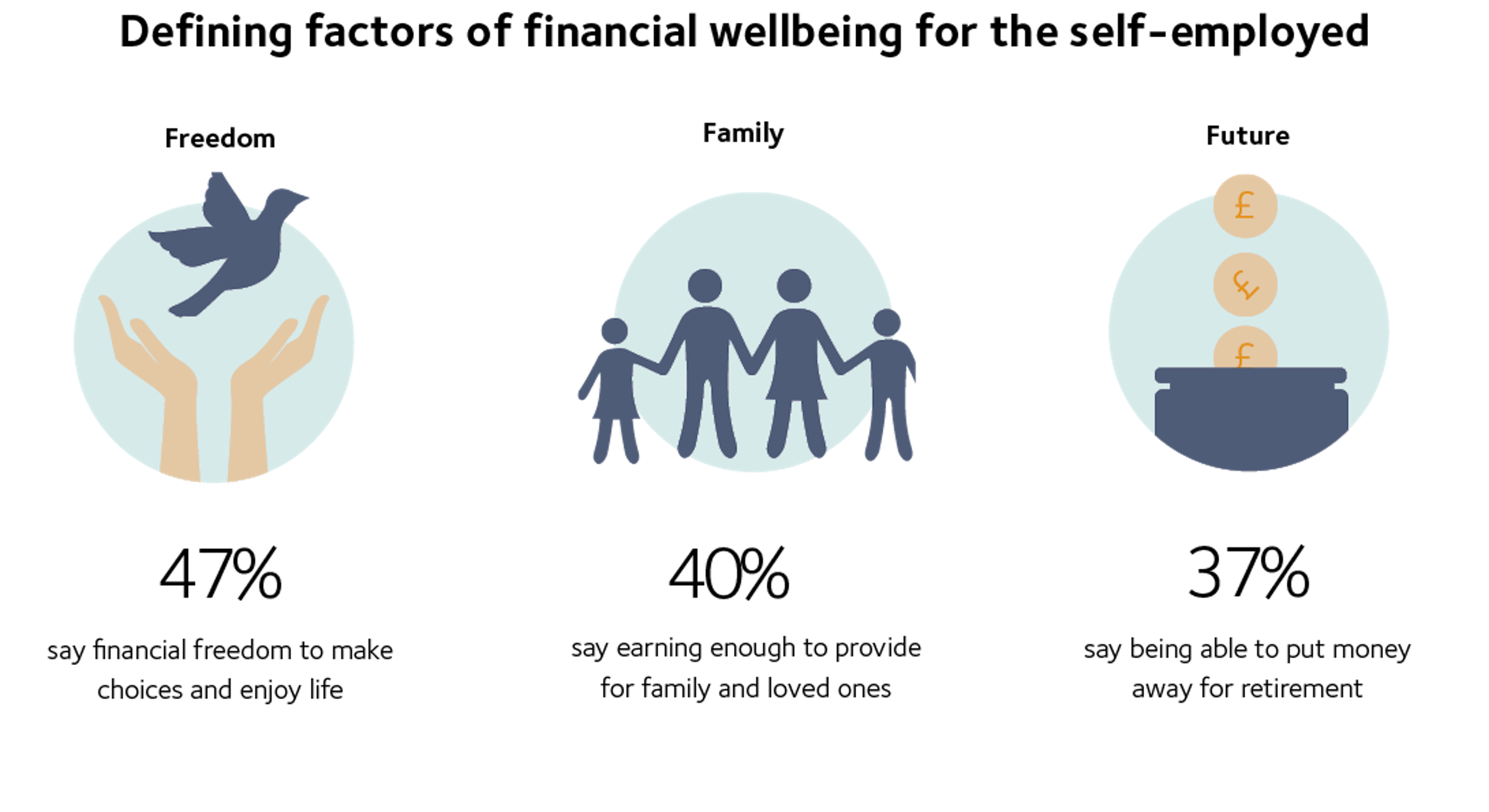

Whether it’s considering their present situation or the future, there are clearly two major factors that affect the financial wellbeing of the self-employed: security and choice. Almost half (46%) of respondents said that having the financial freedom to make choices and enjoy life is the single most decisive factor in their financial wellbeing. Two in five (40%) said earning enough to provide for family and loved ones was another key factor, while 37 per cent said being able to put money away for retirement.

Millennials are more likely to focus on the near future: most indicated that saving for a financial goal or putting money into their savings account on a regular basis suggested good financial health for them. Perhaps unsurprisingly, generation X and baby boomers are more likely to prioritise putting money away for retirement.

For the self-employed overall, ‘financial wellbeing’ means being in a state of financial security that gives them choice in their career and the freedom to enjoy life – as well as the ability to provide for family and loved ones and feel secure in their financial future.

The state of play among the self-employed

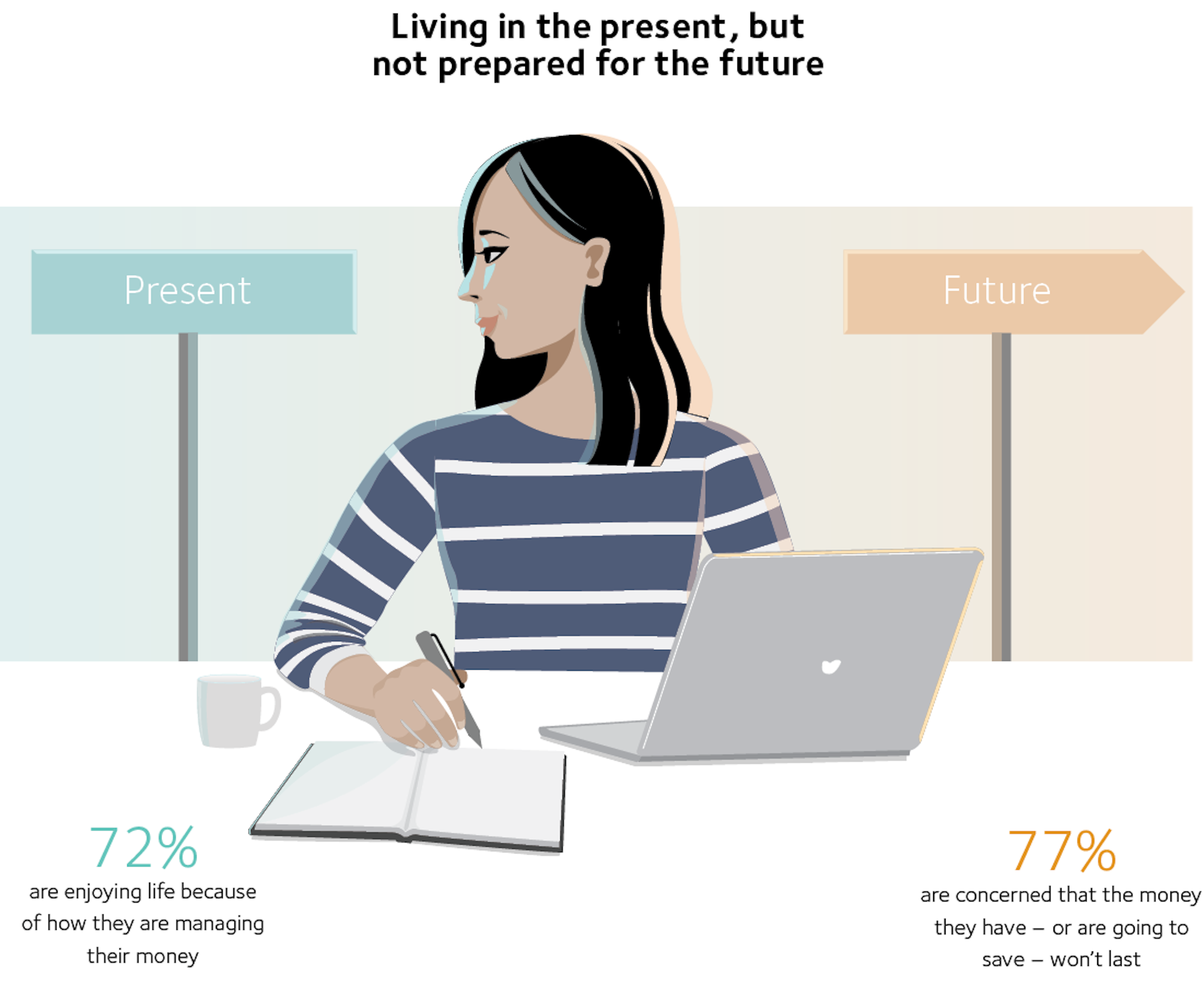

The self-employed are living in the present, but not prepared for the future. At the moment, the majority of the self-employed are enjoying life because of how they are managing their money (72%). However, more than three quarters (77%) are concerned that the money they have – or are going to save – won’t last.

There’s also further evidence that the self-employed see an uncertain future ahead of them: 36 per cent said they do not feel secure in their financial future.

Millennials are particularly exposed to financial uncertainty in the future. Their financial priorities are more likely to be tightly focused on the present and they feel less secure than average in their futures – with four in five (80%) saying that they are concerned the money they have or are going to save won’t last. Consequently, they are also less satisfied with their financial wellbeing and see a lack of financial advice tailored to the self-employed and knowledge on how to manage their finances as some of the main barriers to prosperity.

The survey found further evidence of the importance of money management and savings. Respondents who said they are more satisfied with their financial wellbeing – and are enjoying life because of the way they are handling their money – also said that they feel in a position where they could handle a major unexpected expense and still feel secure in their financial future.

This suggests that the way the self-employed manage their money has a great deal of bearing on overall satisfaction – and might hold the key to reviving confidence in their financial future. It also seems clear, however, that if more is not done to help self-employed people improve their financial wellbeing, it could compromise their personal welfare, as well as their business performance.

Poor financial wellbeing affects performance

The survey showed that nine in ten self-employed people worry – at least occasionally – about their financial situation.

What’s more, half (51%) of those surveyed said they felt anxious or stressed as a result.

A third of respondents also said that worrying about their financial situation had caused them to lose sleep (34%) and experience a lack of confidence (33%).

As well as shorter-term psychological and physical effects, financial worries may also make many people question the long-term sustainability of self-employment.

Of those who had worried about their financial situation, almost half considered giving up self-employment (45%) or accepted work they wouldn’t typically take just to make ends meet (44%).

How to improve financial wellbeing

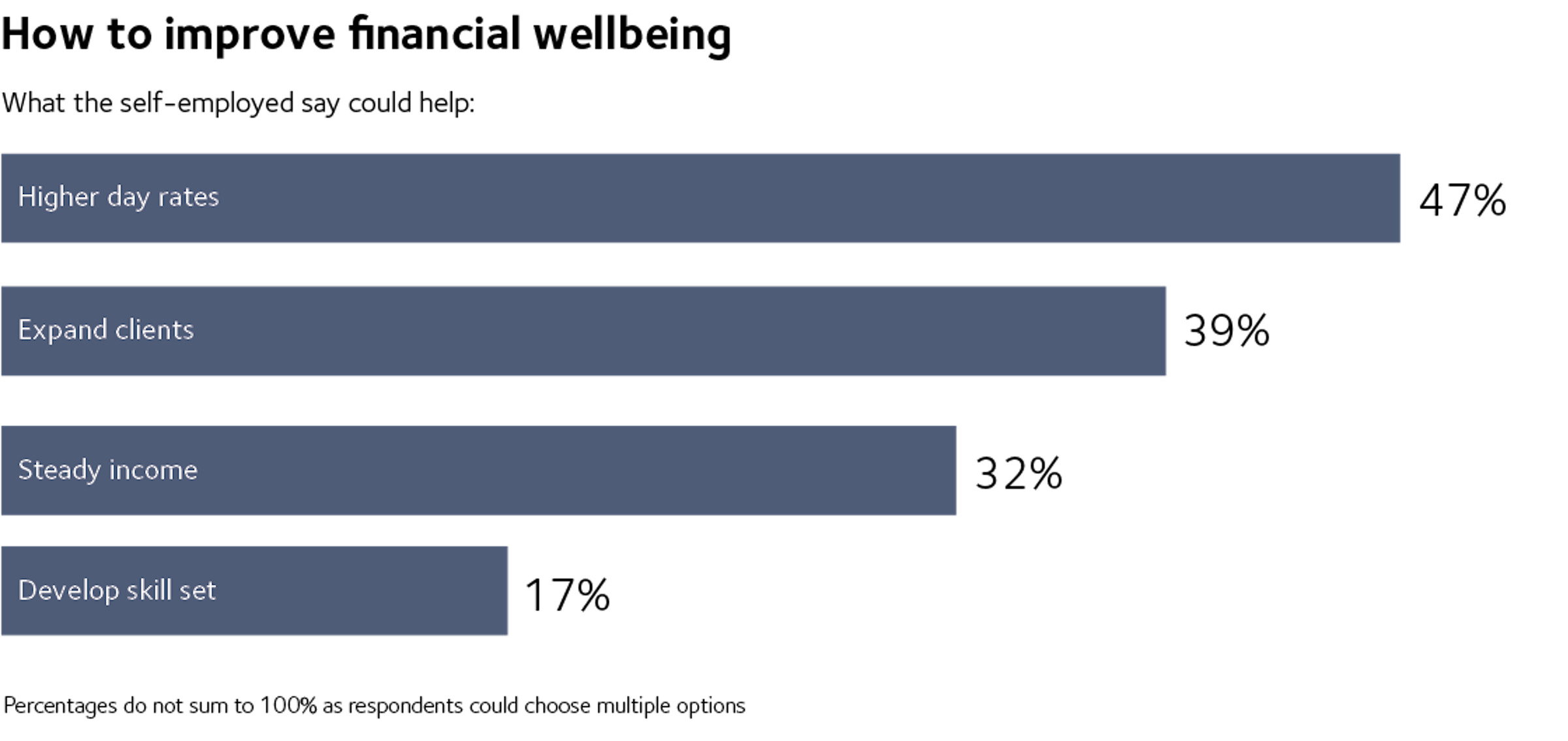

Being self-employed means being the master of your own destiny – and taking on all the financial challenges that it may entail. These everyday challenges are also exacerbated by irregular income patterns and earning potential – as well as limited access to financial support from both government and the financial services industry. These factors can cause significant concerns for the self-employed, but there are a number of things they can do to take control of their financial wellbeing.

Iona Bain on the financial wellbeing of the self-employed

As someone who is both self-employed and discusses people’s finances for a living, I know that self-employed people are well aware that financial wellbeing is paramount. But often, we are operating in a knowledge and support vacuum. My self-employed security has been hard-won: I have struggled over the years to negotiate appropriate pay and improve my cash-flow so that I can make freelancing sustainable. When you’re on your own, just trying to get the basics right, it’s all-too-easy to neglect your long-term finances.

The self-employed financial picture is hugely varied. For example, I earn twice as much as I did a couple of years ago when I was an employee, and work less. Many other self-employed people are reporting even more spectacular gains in money, time and fulfilment after quitting the 9-to-5, making it entirely possible for us to shore up our prosperity. However, self-employed millennials are particularly vulnerable, thanks to a combination of lower earnings (both in absolute and relative terms, compared to the older generation) and housing pressures. Retirement is a long way off for millennials, and we are being asked to contribute much more to receive much less than our parents. This is an unfair and impractical demand, especially since definitions of ‘retirement’ are changing all the time.

We must give millennials more empowering choice about how they manage their long-term finances, rather than keep them tethered to old-fashioned products and attitudes. Self-employed people often have different financial goals and strategies to employees – all of which are misunderstood by policymakers. This research shows just how much we value our freedom, and why measures to ensure that freedom is protected are vital.

For me, one of the key draws of freelancing is the ability to build up my ‘freedom’ fund as I see fit. I may want to build surplus funds to tide me over if I have a child in the future. I may want to invest some of that money back into upskilling. And I sleep better at night knowing I have made some provision for unexpected emergencies and my later life. But as this research rightly identifies, there is a dearth of affordable financial advice available for the self-employed. If the government and financial services industry really want to help the self-employed population, they could and should do more to bolster the legal rights of unpaid suppliers, adapt financial products for the self-employed (i.e. allowing flexible payments to account for irregular income), and keep self-employed taxes steady.

Conclusion

The self-employed are a growing and valuable sector of the UK workforce: in fact, their labour contributes no less than £271bn to the economy.[7] For the individual, being your own boss is a meaningful and rewarding way of working. This satisfaction can, however, be offset by financial concerns – particularly about saving for the future. These concerns can then have a detrimental effect on the personal welfare and performance of self-employed people.

There are several lessons to be taken from this research, which could help the self-employed take control of their financial wellbeing and enjoy a genuinely rewarding freelance career – with the financial security and freedom they need and deserve.

1. Be prepared for periods without work by having insurances and a savings plan in place.

2. Expand your skill set to help increase earning potential and provide an income that allows for saving.

3. Strengthen your business networks to help with the flow of clients and referrals to your business.

4. Put together a financial plan to improve confidence in managing your business and satisfaction with your financial wellbeing.

Appendix

Latest news & opinions

IPSE’s Managing Director, Vicks Rodwell, outlines how our new partnership with Qdos strengthens member protection, enhances expert support and delivers expanded b...

IPSE's Josh Toovey explains why 2026 could bring renewed opportunity for the self-employed after a tough 2025 of limited projects and rising costs.

The festive season is a chance to celebrate another year of hard work, thank clients and colleagues, and relax after filing your tax returns for the last financia...