The Self-Employed Landscape 2019

Our report for 2019 provides a snapshot of how the sector’s size, demographics and economic impact have changed in the past year.

Executive Summary

- The fastest growing solo self-employed age group is the over 60s. The number of over 60 self-employed has grown by 73% since 2008 and grew by 11% in 2019 alone.

- The number of 60 plus freelancers also grew by 7 per cent in 2019.

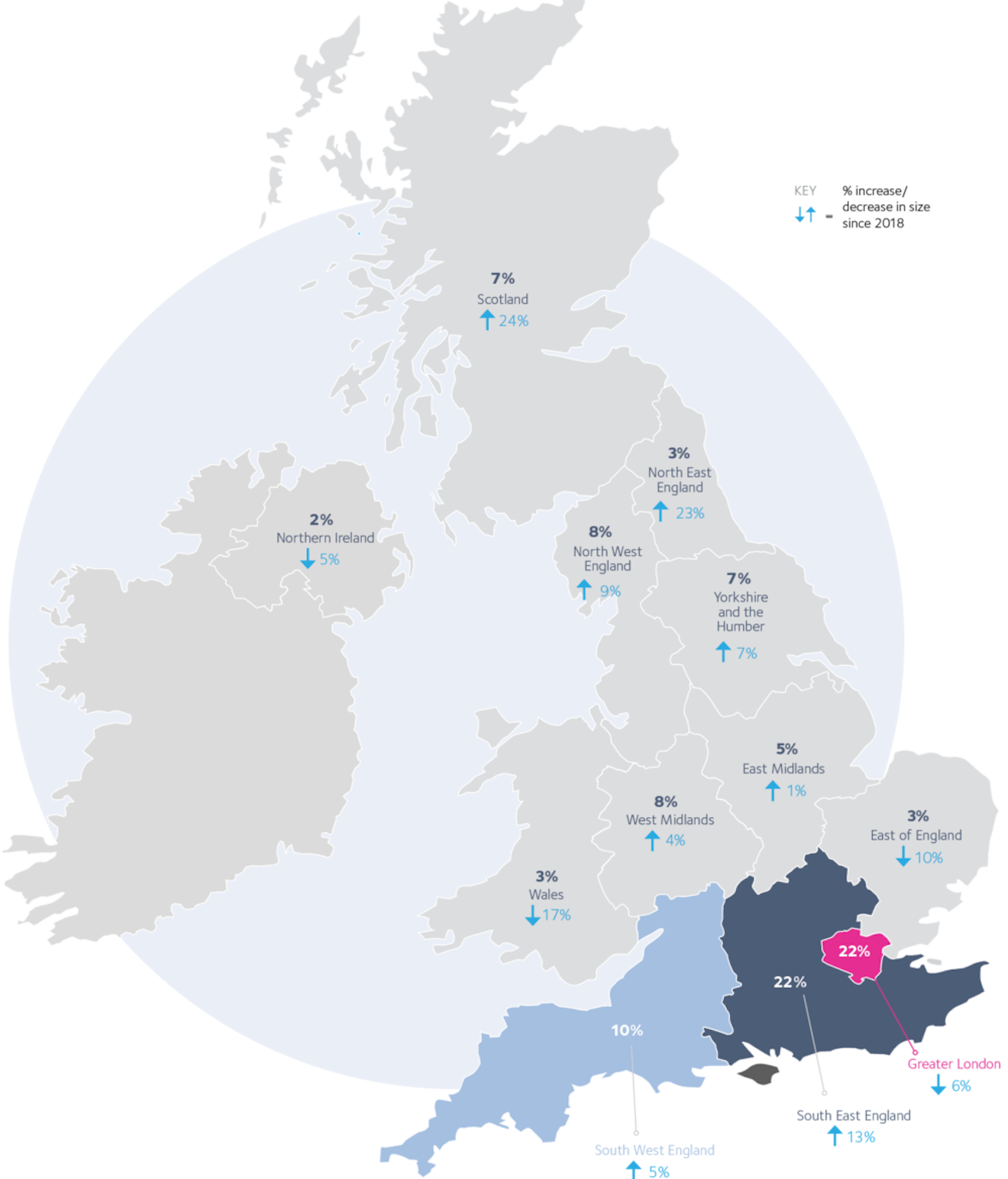

- Across the UK, the number of self-employed is growing fastest in the North East; there has also been rapid growth in Scotland.

- The freelance occupation that grew most in the last year was teaching and educational professionals – a rise of 24 per cent.

The number of solo self-employed and freelancers across the UK continued to rise throughout 2019 – with the biggest growth among over 60s. The number of solo self-employed in this age group rose by 11 per cent, while the number of freelancers rose by 7 per cent.

These increases helped to drive up the age of the average solo self-employed worker to 47 – one year older than in 2018. The average freelancer age also rose by a year to 48. This is compared to an average age of 41 among UK employees.

As the self-employed population is on average older, a growing proportion of self-employed people are now approaching retirement age. This is increasingly worrying because recent research has shown that 30 per cent of the self-employed are not saving for their retirement, while 56 per cent of those over 55 are concerned about saving for later life.

Another group that has grown sharply in the last year is freelancers aged 16-29. The number in this group grew by 12 per cent, while the overall number of young solo self-employed people increased by four per cent. 16-29-year-olds remain, however, the smallest group among both freelancers and the solo self-employed.

Another major area of growth was the regions. Although London and the South East still have the largest of the freelance and self-employed populations, the number of freelancers grew fastest in Scotland (24% increase since 2018), while the number of self-employed people grew most quickly in the North East of England (19% since 2018). By contrast, the number of freelancers in London dropped by 6 per cent and the number of overall solo self-employed fell by 1 per cent.

In 2019, the top freelancer occupations were artistic, literary and media occupations (16% of all freelancers), managers and proprietors (10%), teaching and educational professionals (8%), functional managers and directors (7%) and information technology and telecommunication professionals (5%). These all grew or remained stable throughout the year. The largest growth was among teaching and educational professionals: this group increased by 24 per cent in 2019.

Among the solo self-employed, the top occupations were construction and building trades (444,000), road transport drivers (337,000), artistic, literary and media occupations (336,000) and agricultural and related trades (222,000).

Introduction

Employment and self-employment rose to record highs last year, according to the Office for National Statistics (ONS). The solo self-employed sector now represents 14 per cent of the UK’s workforce, which helps to account for the employment rate rising to 76.1 per cent, the highest since records began in 1974.

Research shows that people are moving into self-employment predominantly for the freedom and flexibility it offers, both in terms of where and when people work, as well as the types of projects people work on.1

These increases have come despite twelve months of political and economic uncertainty driven by Brexit and the sluggish global economy. 2019 was an eventful year politically, with several delays to the UK’s departure from the European Union and the first winter general election in nearly a century.

This turbulence suppressed economic and business confidence, as illustrated by IPSE’s Confidence Index. In quarter 3, freelancers’ confidence both in their businesses and in the wider economy dropped to the lowest on record.2 This held back investment and, as the year went on, hiring decisions across a range of sectors.

It wasn’t all bad for the self-employed community, however, because it benefitted from the need for firms to hire skilled professionals quickly.

The self-employed are a growing and economically significant sector of the UK workforce. In fact, in 2019 alone, they contributed an estimated £305bn to the UK economy. Government are therefore starting to take notice of them. During the 2019 General Election, all the main parties acknowledged the importance of self-employment in their manifestos and pledged to support it.

As self-employment continues to grow in size and significance, it is vital that we strive to better understand this section of the UK working population. That is why IPSE and Kingston University produce an annual report on the demographics and characteristics of the solo self-employed.

This is the eleventh year of IPSE and Kingston University’s joint report, and as ever, it produced some interesting and significant results.

The UK's Solo Self-Employed

Who are they?

This first section looks at the UK’s solo self-employed population. These are people who are running their own business, operating as a sole trader, limited company or in a partnership and do not have any employees.

This population has grown to almost 4.6 million people and has increased by four per cent in the last year alone. The solo self-employed sector accounts for 14 per cent of the entire UK workforce.

Since 2008 the sector has grown by 40 per cent and this increase has been largely driven by the expansion of the freelance sector. Freelancers are a subsection of the solo self-employed who are working in highly skilled managerial, professional and technical occupations; this includes occupations from lawyers and accountants, doctors and scientists, writers and designers to high level managers and directors, to list a few. The freelance subsection continues to thrive and has grown by over 50 per cent since 2008 (53% increase).

As a result of the increase to the number of solo self-employed people now operating in the UK, the sector’s contribution to the UK economy has now increased from £278 billion in 2022 to £331 billion in 2023 – representing a 19 per cent increase.

Our estimation of the contribution to the UK economy uses the Business population estimates for the UK and regions for 20234 and the ONS’s Labour Force Survey for Q2 20235 and takes into account the total turnover of businesses with no employees.

Skill Profile

The skill profile of the UK’s solo self-employed is based on the Standard Occupational Classifications (SOCs), an internationally recognised system that classifies occupations according to the skill level required for them.6 There are currently nine major levels of SOC codes ranging from managers, directors and senior officials at the top end to elementary occupations in SOC9, which generally require a minimum level of qualifications.

Interestingly, when looking at changes in the size of SOC groups within the solo self-employed population, increases in the size of the highest skilled occupational categories have been offset by decreases in largely lower skilled occupational groups.

For instance, the number operating in SOC2 professional occupations has increased by 15 per cent since 2022, which equates to 109,000 more solo self-employed in this occupational category.

Similarly, the number in SOC3 associate professional and technical occupations has also increased by 10 per cent, whilst SOC1 managerial occupations have seen an increase of seven per cent since 2022, equivalent to an additional 70,000 and 27,000 individuals respectively.

SOC4 administrative and secretarial occupations have remained relatively stable since 2022, increasing by just one per cent in this time (equivalent to just 1,900 individuals).

On the other hand, SOC6 caring, leisure and other service occupations have seen a decrease of 20 per cent since last year, decreasing by 78,000 individuals.

In addition, SOC5 skilled trades occupations have also decreased by five per cent – equivalent to a loss of 47,000 self-employed individuals – whilst SOC8 process, plant and machine operatives decreased by six per cent (equivalent to a loss of 25,000 individuals).

Interestingly, the number operating in SOC7 sales and customer service occupations has remained the same since 2022.

Despite lower skilled occupational categories appearing to offset many of the increases found in higher skilled occupational categories over the past year, the greatest percentage increase since 2022 can be found in SOC9 elementary occupations. This has now increased by 19 per cent in the past 12 months, an increase of around 45,000 self-employed individuals.

Top Occupations

In the one to nine major SOC groups there are over 90 minor occupational categories. Looking closely at these can give a more detailed understanding of the kinds of roles solo self-employed people are working in.

The highest proportion of the UK’s solo self-employed is working in the construction and building trades (444,000), as road transport drivers (337,000), in artistic, literary and media occupations (336,000) and in agricultural and related trades (222,000).

Gender

The gender distribution of the UK’s self-employed workforce remains uneven, but has seen a small shift in the last year in favour of women. The population is now 64 per cent male and 36 per cent female.

There is a more even gender distribution in the higher occupational categories (SOC1 to SOC3), where 42 per cent are female and 58 per cent are male – unchanged since 2018.

Men dominate in most of the occupational categories, however, there are higher proportions of women in medium skilled occupations such as SOC4 (administrative and secretarial occupations – 79% female) and SOC6 (caring, leisure and other service occupations, including hairdressing and housekeeping – 87% female).

The lowest proportion of females can be found in the largest occupational group, SOC8 (process, plant and machine operatives – 9% female). The fact that men dominate the largest occupational groups explains the overall gender imbalance in the solo self-employed population.

Despite this, there have been large increases in the number of self-employed women since 2008. In fact, the number of women has risen by 67 per cent, while the number of men increased by just 28 per cent over the same period.

The number of women increased remarkably over the last decade and has continued to increase at a faster rate than men over the last year with a six per cent increase in women compared to a two per cent increase in the number of men.

Working Mothers

In the UK there are a total of 611,000 solo self-employed mothers, just under half of whom are working in SOC1 to SOC3 highly skilled occupations. This means that one in eight of all solo self-employed people are now working mothers (working mothers are defined as women with dependent children aged 16 or under).

The number of solo self-employed mothers has increased by a total of 61 per cent since 2008. Mothers are most likely to be working in SOC6 (caring, leisure and other service occupations including caring, leisure and travel – 147,000), SOC3 (associate professional and technical occupational groups – 124,000) and SOC2 (professional occupations – 110,000).

Between 2018 and 2019 the number of self-employed mothers has continued to increase (4% increase). However, there was a small decrease of one per cent in mothers working in highly skilled occupations over the last year.

Age

The average age of the UK’s solo self-employed is 47 years old, one year older than in 2018. The largest age groups in 2019 are 40-49 years (1,083,000) and 50-59 years (1,167,000). Combined, these two groups account for almost 50 per cent of the whole solo self-employed population.

The smallest proportion of the solo self-employed workforce is in the 16-29 age group and accounts for 12 per cent of the sector. This group has, however, grown by four per cent over the last year in line with the overall growth.

The highest growth has been in the 60-plus age range which has seen an increase of 73 per cent since 2008 and an increase of 11 per cent in the last year alone.

These figures reveal that an ever-growing proportion of the self-employment population are rapidly approaching retirement age. Given that recent research has shown that 30 per cent of the self-employed are currently not saving for later life and 67 per cent are concerned about their savings, this is increasingly worrying.3

Disability

A recent report by IPSE revealed that in 2018 there were 611,000 solo self-employed people in the UK who were considered disabled under the Equality Act 2010. The research revealed that these individuals were on the whole choosing self-employment for positive reasons, including better job satisfaction, improved working conditions and to enable them to work effectively around their disability.

The figures reveal that this sector has grown by a further eight per cent in 2019 alone to over 662,000 people.

The UK's Freelance Workforce

Who are they?

Freelancers are a subset of the solo self-employed population who are working in the top three highest skilled occupational categories (SOC1 to SOC3). This includes managers and directors, professionals and associate/technical professionals.

In 2019 there were more than 2.1 million freelancers in the UK. Over 1.9 million stated that freelancing is their main job with a further 234,000 people doing freelancing as a side hustler alongside other employment.

Similar to previous years, freelancers account for 46 per cent of the 4.6 million-strong solo self-employed population and represent six per cent of the entire UK workforce. Since 2008, the freelance sector has seen a 53 per cent increase, while in the last year it grew by a further four per cent. There has been higher growth across the sector in 2018-19 as compared to 2017-18.

Skill profile

The largest group of freelancers, accounting for 814,000 people or 38 per cent, are those working in associate professional and technical occupations (SOC3). This group contains a wide range of occupations including artists, writers, health associates, designers, sales and marketing professionals and business and finance associate professionals.

A total of 767,000 freelancers work in professional occupations (SOC2) and the remaining 548,000 work in managerial occupations (SOC1).

Although SOC3 remains the largest group, SOC1 and SOC2 have seen the largest increases since 2008 (53% and 86% respectively) and are largely responsible for the overall growth of the freelance population in this period. SOC2 has also seen an increase of 12 per cent in the last year, the largest annual increase of any freelancer group.

Top Occupations

Looking at the occupational categories in more detail reveals that freelancers are most likely to work in artistic, literary and media occupations (16%), as managers and proprietors (10%), teaching and educational professionals (8%), functional managers and directors (7%), and information technology and telecommunication professionals (5%). This is a largely similar pattern to previous years and amounts to 46 per cent of all freelancers.

All of the occupations in these top five categories have grown or remained stable between 2018 and 2019. Teaching and educational professionals have seen the largest growth with an increase of 24 per cent in the last year alone.

The occupational groups that have seen the most growth in the last year were welfare and housing associate professionals (79%), legal professionals (66%) and public service associates (35%). Functional managers and directors, artistic, literary and media occupations and sports and fitness occupations and sales and marketing associate professionals have all more than doubled since 2008.

Gender

The UK’s freelance population is made up of 58 per cent males and 42 per cent females. This is a more even distribution than the overall UK solo self-employed population, which is 64 per cent male and 36 per cent female.

Similar to last year, females account for 42 per cent of SOC2 and 44 per cent of SOC3 freelancers. However, the proportion of women drops to 38 per cent in SOC1 occupations. This demonstrates that female freelancers remain less likely to work in the highest skilled occupational group than men.

The growth of the freelance sector has been driven largely by female freelancers who have seen an increase of 69 per cent since 2008. This is compared to a 43 per cent increase in the number of male freelancers over the same time period.

Working mothers

There are currently 302,000 freelance mothers in the UK, accounting for around 14 per cent of the total freelancer population. In fact, one in seven of all freelancers are working mothers.

There are large numbers of mothers across all freelancer occupational groups, including managerial and senior positions (69,000), professional occupations (110,000) and associate professional and technical occupations (124,000).

The number of freelance mothers has grown by approximately 79 per cent since 2008, but saw a small decrease of one per cent over the last year. The decrease is mainly in SOC3 occupations, with SOC2 occupations actually seeing an increase of six percent.

Age

As with the wider solo self-employed population, among freelancers the largest age groups are 40-49 (505,000) and 50-59 (557,000). Combined, these groups account for 50 per cent of all freelancers. As a result, the average age of UK freelancers is 48 years old – one year older than the overall solo self-employed average.

The largest increases over the last year were seen in the age groups at both ends of the spectrum, with an increase of 12 per cent in the 16-29 age band and an increase of seven per cent in the 60-plus age group.

Despite increases in the last year, the 16-29-year-old group accounts for only 10 per cent of freelancers, making them the smallest freelancer age group with around 223,000 individuals.

Disability

This year the numbers of highly skilled freelancers considered as disabled under the Equality Act 2010 was almost 294,000 or 44 per cent of the total number of disabled self-employed individuals.

In contrast, only 38 per cent of employees classified as disabled under the Equality Act are working in the top three occupational categories.

Location

Freelancers have a similar geographical distribution to the overall solo self-employed population.

However, a larger proportion of them live in Greater London (22% compared to 18% of the overall solo self-employed).

Interestingly, Greater London has seen one of the largest decreases in freelancers over the last year with numbers dropping by six per cent; this in contrast to the 20 per cent growth in freelancers London saw the previous year.

Some regions have seen large increases in freelancers over the last year. For example, Scotland is now home to 144,000 freelancers, an increase of 24 per cent since 2018. The North East of England also saw an increase of 23 per cent, raising the total number of freelancers in this region to 74,000.

Conclusion

Freelancers have a similar geographical distribution to the overall solo self-employed population.

However, a larger proportion of them live in Greater London (22% compared to 18% of the overall solo self-employed).

Interestingly, Greater London has seen one of the largest decreases in freelancers over the last year with numbers dropping by six per cent; this in contrast to the 20 per cent growth in freelancers London saw the previous year.

Some regions have seen large increases in freelancers over the last year. For example, Scotland is now home to 144,000 freelancers, an increase of 24 per cent since 2018. The North East of England also saw an increase of 23 per cent, raising the total number of freelancers in this region to 74,000.

Latest news & opinions

IPSE's Joshua Toovey outlines the top five tax tips for the self-employed so you can get ahead of next year's tax year end.

Following a ruling that four sports broadcasters broke rules on coordinating their freelancers' pay, IPSE's Fred Hicks looks at the options for levelling the play...

IPSE's Joshua Toovey runs through the key announcements for the self-employed at the 2025 Spring Statement.