The Self-Employed Landscape 2021

Our report for 2021 provides a snapshot of how the sector’s size, demographics and economic impact have changed in the past year.

Executive Summary

- The total solo self-employed population has shrunk by five per cent for the second year running

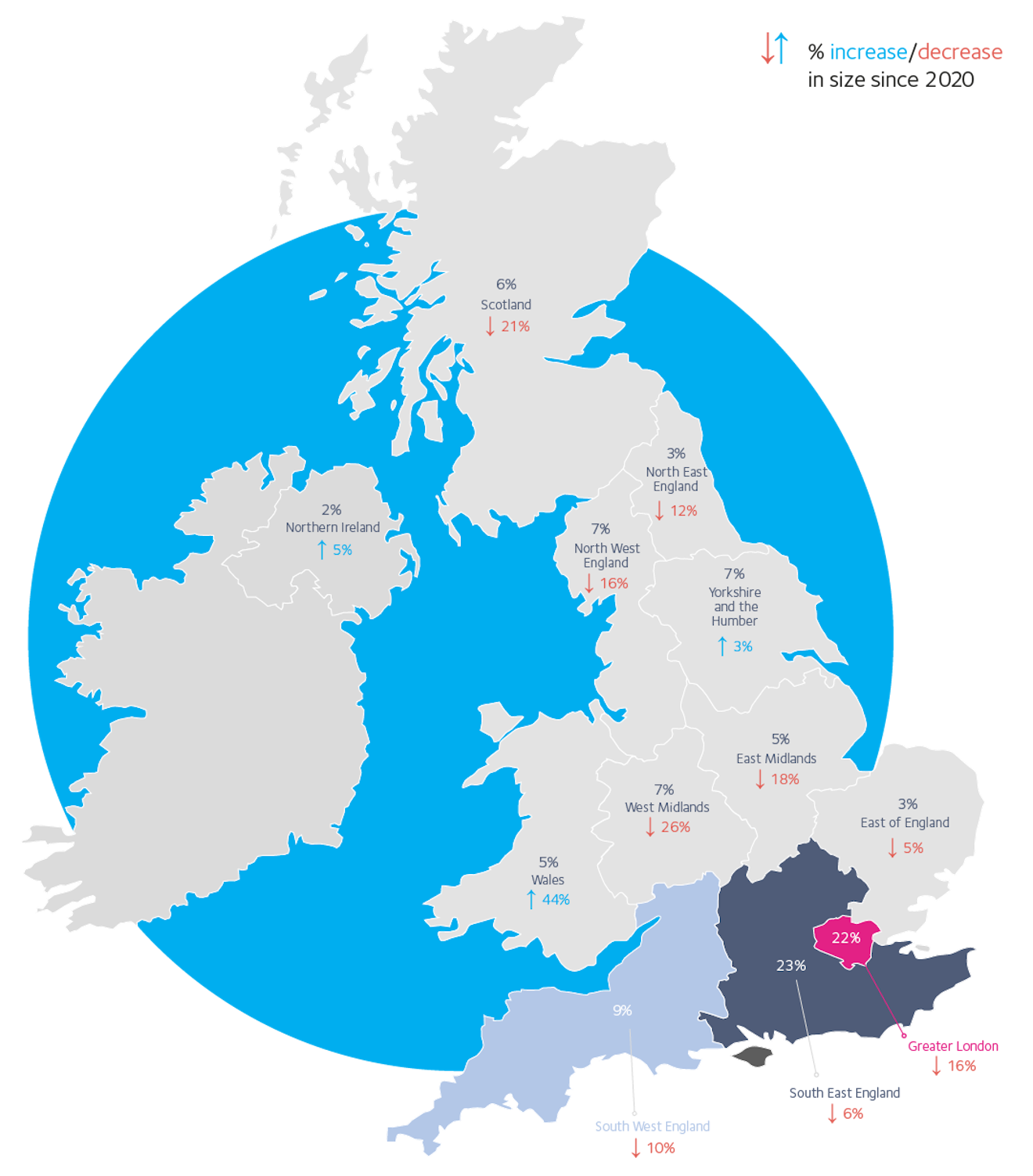

- Regionally, Wales, the East of England and the North East saw increases in solo self-employed workers

- Universal credit claimants by solo self-employed workers continue to rise

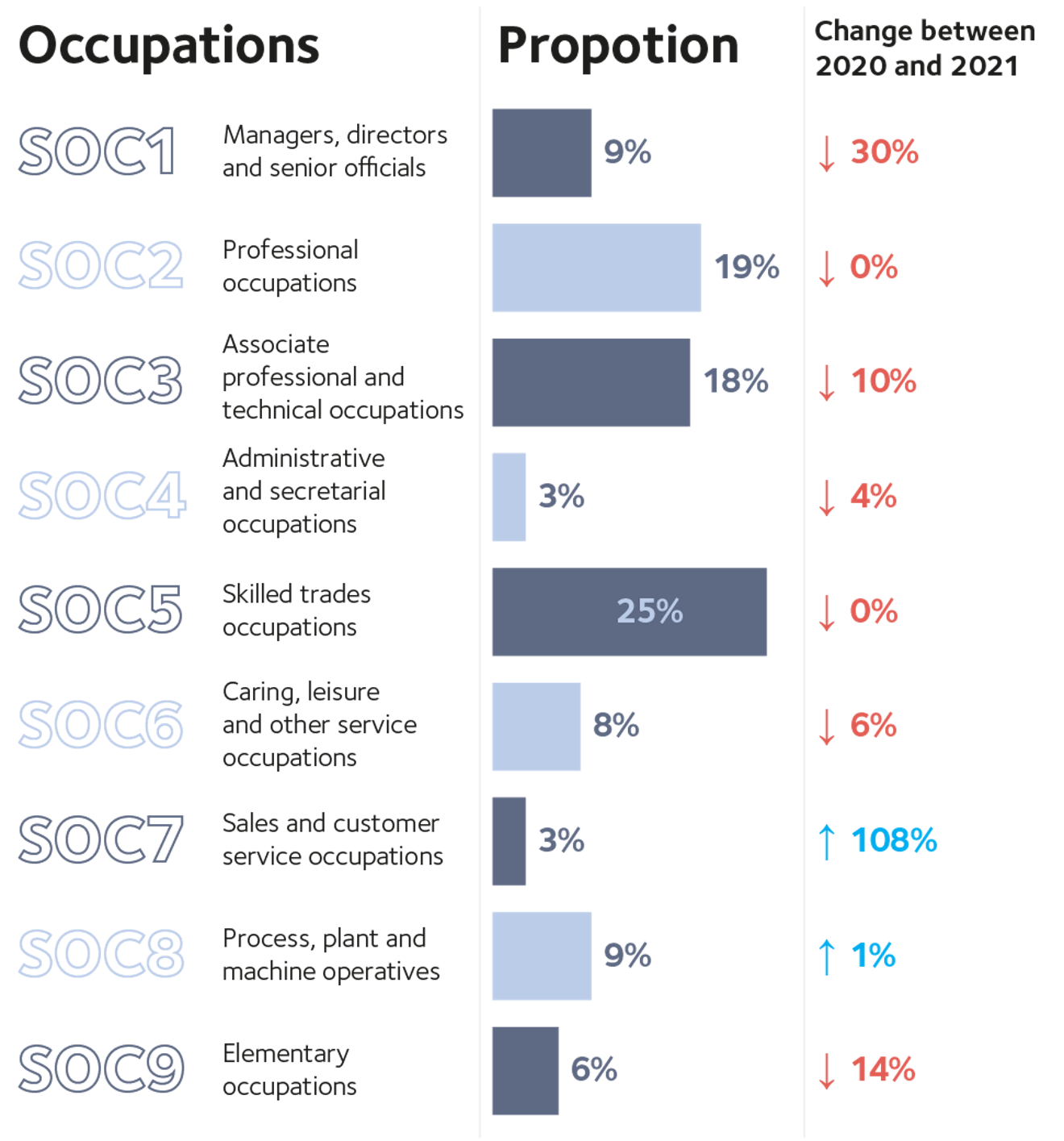

Of all skill groups, the biggest decline was a 30 per cent drop in the number of managers, directors and senior officials (SOC1)

Following another year of COVID-19 uncertainty and lockdown restrictions, the number of solo self-employed workers in the UK (excluding those who have others working for them) has fallen by five per cent from 4.3 million in 2020 to 4.1 million in 2021. The fall is the second consecutive year that the solo self-employed population has decreased – representing a clear break from the 40 per cent growth in self-employed workers between 2008 and 2019.

Despite the fall, self-employed workers continue to contribute an estimated £303 billion to the UK economy. Moreover, highly skilled freelancers - that play a critical role in the economy by enabling businesses to manage and reduce entrepreneurial risk - are estimated to provide approximately £147 billion of the £303 billion that solo self-employed workers generate.

Skills and occupations

In terms of skills and occupations, the majority of Standard Occupational Categories (SOC) experienced significant decreases over the past year. SOC1 managers, directors and senior officials saw the biggest decrease in numbers, with the skill group falling by 30 per cent between 2020 and 2021.

The only skill groups to increase last year were SOC8 and SOC7. SOC8 (process, plant and machine operatives) saw a modest increase of one per cent, while SOC7 (sales and customer service occupations) grew more rapidly at 108 per cent since 2020.

Looking at specific occupations, the number of people working in the biggest solo self-employed occupational group, construction and building trades, dropped by ten per cent to 366,000. The third biggest group, artistic, literary and media occupations also decreased, with numbers falling by 14 per cent to 258,000.

On the other hand, road transport drivers and agricultural and related trades occupational numbers both rose by six per cent to 276,000 and 185,000 respectively.

Among highly skilled freelancers, there was even more variation, with managers and proprietors and functional managers and directors experiencing a 44 per cent and 26 per cent decrease between 2020 and 2021. Conversely, therapy professionals and media professionals experienced increases of 29 per cent and 41 per cent respectively since 2020, with each occupational group now accounting for four per cent of all freelancers.

Demographic shifts

While self-employed workers remain overwhelmingly male and middle-aged, there are signs that the workforce is slowly becoming more representative of the overall population. The small swing in favour of women we saw in the last two reports for 2019 and 2020 has continued this year, with the number of female self-employed workers increasing by one percentage point compared to 2020.

Moreover, while the total number of solo self-employed mothers has decreased by nine per cent since 2020, the number of working mothers has still increased by 40 per cent since 2008.

Disabled people are increasingly joining the self-employed workforce, with there being a seven per cent increase in the number of solo self-employed with a disability since 2020.

The average age of solo self-employed workers, on the other hand, remains the same as in 2019 and 2020 at 47 years old. The largest age groups in 2021 are 50-59 years (1,080,374) and 40-49 years (904,966). When taken together, these two groups account for almost half of the whole solo self-employed population (49%).

Regional differences

The decline of the solo self-employed has been very varied across the UK’s regions. There was a moderate decrease in most regions and the only increases were in Wales (30%), East of England (8%) and the North East (4%). Northern Ireland and Scotland reported the largest decreases at 31 per cent and 15 per cent respectively. The sharpest declines in the highly skilled freelance sector were concentrated in the West Midlands at 26 per cent.

Benefits

Despite the number of solo self-employed workers claiming benefits decreasing by five per cent between 2020 and 2021, universal credit claimants have increased by 15 per cent, with an additional 33,000 individuals now using universal credit. The 15 per cent increase in those claiming Universal Credit is particularly concerning given that this follows a 341 per cent increase experienced between 2019 and 2020.

Introduction

The self-employment sector has suffered over the past year from several key factors and periods of uncertainty, restrictions and reforms. The impact of the pandemic and the remaining sectoral support gaps in government support has largely continued with coronavirus-related restrictions ongoing in some form until July 19, 2021. In addition, freelancers have also had to contend with the imposition of the off-payroll working (IR35) reforms which came into effect in April 2021.

IPSE’s own research has revealed that three out of five freelancers (60%) experienced a decrease in turnover as a result of the pandemic with two out of three freelance businesses (67%) negatively affected by the impact of the pandemic.1

Despite the government introducing the Self-Employed Income Support Scheme, the eligibility criteria left out large sections of freelancers – including the newly self-employed, people with annual profits over £50,000 and limited company directors.

Although some newly self-employed were eventually included in the later SEISS grants, limited company directors and those with annual profits over £50,000 were left without support for most of the pandemic, which forced many to take on debt to keep their business afloat – and drove many others out of self-employment altogether.

Overall, while 3.4 million self-employed people were eligible for the Self-Employment Income Support Scheme, approximately 1.6 million of the 5 million people who were self-employed at the start of the pandemic were excluded from support.2

In addition to the impact of the pandemic and gaps in support, freelancers have had to contend with the reforms to IR35 in the private sector. These changes to the off-payroll tax legislation moved the responsibility for determining IR35 status from contractors to end clients.

Prior to the implementation of IR35 changes, many self-employed individuals were concerned about how the reforms would impact status determinations, with many clients already expressing fears of falling foul of the rules. In fact, research showed that 24 per cent of freelancers were planning on seeking contracts abroad, 19 per cent intended to work via an umbrella company whilst 17 per cent planned to seek an employed role.3

Now since the imposition of the reforms on the private sector, IPSE’s latest research reveals that over a third of contractors (35%) have left self-employment whilst of those who remain, over a third (34%) are now working through umbrella companies.4

The IR35 reforms have also had a financial consequence, with the majority (80%) of those now working within IR35 reporting that their quarterly income has decreased since the introduction of the IR35 changes – with a quarter (25%) experiencing decreases of 40 per cent or more.

This report examines two subsets of the overall self-employment sector: the solo self-employed – those who are self-employed but do not employ others – and freelancers – those who are working in the top three highest skilled occupational categories (SOC1 to SOC3). From analysis of the ONS Labour Force Survey (LFS) data from Q2 2021, the report will review demographics and highlight any changes to the sector over the last year.

The UK's Solo Self-Employed

In this first section, we explore the UK’s solo self-employed population in more detail using data from the second quarter of the Labour Force Survey in 2021, 2020 and 2008. The solo self-employed are defined as individuals who are running their own business, operating as a sole trader or in partnership and do not have any employees.

Following the downward trend from last year’s report, this year we continue to see a decrease in the number of solo self-employed people in the UK. Similar to the drop seen last year, this year there has been a decrease of five percent compared to 2020 with the population now standing at 4.1 million people.

The last two years have reversed the trends seen since 2008 where the sector has grown year on year, largely driven by the expansion of the freelance sector. Freelancers are a subsection of the solo self-employed that includes highly skilled managers, directors, professionals and associate/technical professionals.

Despite this, the solo self-employed population contribute an estimated £303 billion to the UK economy.

Skill Profile

The skill profile of the UK’s solo self-employed is based on the Standard Occupational Classifications (SOCs), an internationally recognised system that classifies occupations according to the skill level required for them.5 There are currently nine major levels of SOC codes ranging from managers, directors and senior officials at the top end to elementary occupations in SOC9, which generally require a minimum level of education.

The majority of SOC groups have seen decreases in solo self-employed people between 2020 and 2021 with the biggest decrease in numbers seen in SOC1 managers, directors and senior officials occupations which dropped by 30 per cent. SOC9 elementary occupations also saw a decrease of 14 per cent in the number of solo self-employed people working in these occupations whereas SOC3 associate professional and technical occupations saw a 10 per cent decrease.

In addition, SOC8 process, plant and machine operative occupations saw a modest increase of one per cent between 2020 and 2021.

Interestingly, SOC7 sales and customer service occupations, which has historically been the smallest group, has increased by 108 per cent since 2020, representing by far the biggest increase in any one SOC group.

Due to the large decreases seen in SOC1 managers, directors and senior official occupations and SOC3 associate professional and technical occupations, freelancers (those working in SOC 1-3 occupations) have overall seen a drop of 11 per cent between 2020 and 2021. Freelancers now account for 45 per cent of the solo self-employed population as a whole which represents a drop of 4 percentage points compared to last year.

The group with the highest number of solo self-employed people remains SOC5 skilled trades occupations including sectors ranging from construction and agriculture to textiles and food preparation. This group accounts for 25 per cent of the total solo self-employed population and has remained stable between 2020 and 2021.

Top Occupations

In the one to nine major SOC groups there are 90 minor occupational groups. Looking closely at these can give a more detailed understanding of the kinds of roles solo self-employed people are working in.

Similar to previous years, the highest proportion of the UK’s solo self-employed are working in the construction and building trades (366,000), as road transport drivers (276,000), in artistic, literary and media occupations (258,000) and in agricultural and related trades (185,000). This year, however, the number of solo self-employed people working in construction and building trades has decreased by 10 per cent and those working in artistic, literary and media occupations has decreased by 14 per cent.

On the other hand, between 2020 and 2021 there was a six per cent increase in both the number of solo self-employed people working as road transport drivers and those working in agricultural and related trades.

Gender

Whilst the gender distribution of the UK’s self-employed workforce remains uneven, the small swing in favour of women we saw in the last two reports for 2019 and 2020 has continued this year. The overall solo self-employed population is now 61 per cent male and 39 per cent female, representing a one percentage point increase in the proportion of women compared to 2020.

Overall, there was a drop of seven per cent in the number of men compared to a drop of three per cent in the number of women. Interestingly, the number of men has increased by 10 per cent since 2008 whilst the number of women has increased by 59 per cent since 2008.

Looking at higher occupational categories (SOC1 to SOC3), there is a more even gender distribution, with men making up 54 per cent and women 46 per cent of the population.

Men continue to dominate in most of the occupational categories, such as in SOC5 skilled trades occupations (88%), SOC8 process, plant and machine operatives (87%) and in SOC9 elementary occupations (61%). However, women dominate SOC6 caring, leisure and service occupations (84%) and SOC4 administrative and secretarial occupations (81%).

The lowest proportion of females can be found in SOC5 skilled trades occupations (12%) and in SOC8 process, plant and machine operatives (13%).

Working Mothers

There are now a total of 532,661 solo self-employed mothers, which represents 13 per cent of all solo self-employed people. Over half (52%) of working mothers are now working in SOC1 to SOC3 highly skilled occupations.

The total number of solo self-employed mothers has decreased by nine per cent since 2020, however, the number of working mothers has still increased by 40 per cent since 2008.

Self-employed mothers are now most likely to be working in SOC2 professional occupations (117,000), SOC3 associate professional and technical occupations (115,000) and SOC6 caring, leisure and service occupations (104,000).

Interestingly, since 2020, the numbers of solo self-employed mothers working in SOC5 skilled trades occupations and SOC8 process, plant and machine operatives has increased by 70 per cent and 25 per cent respectively.

Age

The average age of the UK’s solo self-employed remains the same as in 2019 and 2020 at 47 years old. Similar to our reports in 2019 and 2020, the largest age groups in 2021 are 50-59 years (1,080,374) and 40-49 years (904,966). When taken together, these two groups account for almost half of the whole solo self-employed population (49%).

The smallest proportion of the solo self-employed workforce can be found in the 16-29 years age group, accounting for just 12 per cent of the sector. This group has also seen the largest proportional drop in numbers between 2020 and 2021, dropping by 25 per cent (equivalent to 58,000 individuals).

Concerningly, all age groups decreased in size between 2020 and 2021 with those aged between 40-49 and 50-59 also dropping by 17 per cent and eight per cent respectively (equivalent to 86,000 and 44,000 individuals).

Length of time in self-employment

Now focusing on the length of time that the UK solo self-employed workforce have been self-employed reveals that 41 per cent have been working this way for over ten years which closely aligns with previous research revealing that those entering self-employment do so for overwhelmingly positive reasons6 – clearly entering self-employment for the long run.

Similarly, 20 per cent of the solo self-employed workforce began self-employment between 2014 and 2017 whilst a further nine per cent became self-employed between 2011 and 2013.

At the other end, 13 per cent have only entered self-employment since 2020, equating to 484,000 newly self-employed individuals.

Disability

The number of solo self-employed people in the UK who were considered disabled under the Equality Act 2010 has been increasing year on year since 2013, increasing by 39 per cent during this time.

In fact, 21 per cent of disabled people reported that they had made the move into self-employment for better work or job satisfaction.7

After last year’s report revealed there had been an eight per cent drop in the number of self-employed disabled people between 2019 and 2020, this year’s figures now show a seven per cent increase in the number of solo self-employed disabled.

In comparison, the number of disabled employees has increased by eight per cent during the same period (2020 to 2021).

The seven per cent increase in the number of solo self-employed disabled is largely driven by males who have seen a 12 per cent increase between 2020 and 2021 (equivalent to 40,000 individuals) compared to a one per cent increase in the number of females (equivalent to 2,000 individuals).

The age group that has seen the highest increase amongst the solo self-employed disabled is the 16-29 age band, experiencing an increase of 29 per cent (equivalent to 13,000 individuals).

Benefits

The Labour Force Survey also asks people to indicate whether they were claiming any state benefits or tax credits during a specific one-week period in the quarter.

Now looking at the data for Q2 2021 reveals that the number of solo self-employed claiming benefits has decreased by five per cent between 2020 and 2021.

Concerningly, however, the number of solo self-employed claiming universal credit has increased by 15 per cent between 2020 and 2021, with an additional 33,000 self-employed individuals now claiming universal credit. The 15 per cent increase in those claiming Universal Credit is particularly concerning given that this follows a 341 per cent increase experienced between 2019 and 2020.

Between 2020 and 2021, 12 per cent of the solo self-employed workforce were claiming child benefit whilst seven per cent claimed pension benefits, including state pension or pension credit. This represents a 15 per cent decrease in the number claiming child benefit and a six per cent decrease in the number claiming pension benefits since 2020.

Location

The solo self-employed continue to be found in all regions of the UK, but most prominently concentrated in the South East (22%), London (17%) and the South West (10%). When taken together, these areas account for almost half of the entire sector (49%).

As expected with the drop in the number of solo self-employed, most areas saw a decline in their self-employed populations, with Northern Ireland and Scotland reporting the largest decreases (-31% and -15% respectively).

Similarly, despite still accounting for almost half of the sector, the South East (-7%), London (-6%) and the South West (-3%) all experienced decreases in their self-employed populations.

The West Midlands and East Midlands also recorded decreases in their self-employed populations, decreasing by 14 per cent and 11 per cent respectively.

Wales, on the other hand, experienced a 30 per cent increase in their self-employed population – equivalent to 49,000 newly self-employed individuals now operating in Wales between 2020 and 2021.

In addition, the East of England and the North East also experienced small increases in their solo self-employed populations, increasing by eight per cent and four per cent respectively.

The UK's Freelance Workforce

Freelancers are a subsection of the solo self-employed population who are working in the top three highest skilled occupational categories (SOC1 to SOC3). This subsection includes highly skilled managers, directors, professionals and associate/technical professionals, including occupations from lawyers and accountants, doctors and scientists, to writers and designers.

There are now 1.9 million freelancers in the UK, down 11 per cent from 2020. Due to this decrease in the number of freelancers between 2020 and 2021, the number of freelancers as a proportion of the overall solo self-employed population has decreased by three percentage points from 49 per cent to 46 per cent.

Contribution

Previous research has shown that freelancers play a critical role in the economy by enabling businesses to manage and reduce entrepreneurial risk, enable the de-risking of uncertainties in the market and reduce the amount of finance required for innovation and business start-ups; ultimately promoting innovation, enterprise and growth.8

Whilst there are no official statistics directly measuring freelancers’ contribution to the economy, it is, however, possible to provide a speculative estimate. If freelancers’ contribution to turnover is proportionate to their presence in the wider group of businesses without employees, their collective sales would be approximately £132 billion. This would comprise 44 per cent of the £303 billion contributed by the UK’s wider solo self-employed workforce.

This figure could be even higher as freelancer-owned businesses may be expected to generate greater revenues than businesses in the lower-skilled occupational categories because of their level of knowledge and skill. Their contribution to the UK economy in 2021 could even be as high as £147 billion.

Skill profile

The largest group of freelancers, accounting for 762,000 individuals and 41 per cent of all freelancers, are those working in SOC2 professional occupations. This figure remains similar to the figure reported for this group in 2020 (759,000) but also represents an 84 per cent increase in the population for SOC2 professional occupations since 2008.

SOC3 associate professional and technical occupations now account for 738,000 individuals and 40 per cent of all freelancers, representing a nine per cent decrease between 2020 and 2021.

Furthermore, SOC1 managers, directors and senior officials have also seen a decrease in their population since 2020, dropping by 30 per cent (equivalent to 155,000 individuals).

Top occupations

Now looking across the occupational categories in more detail reveals that occupations across the sector have been affected in different ways between 2020 and 2021.

The largest occupational group for freelancers remains those operating in artistic, literary and media occupations which now account for 17 per cent of all freelancers after seeing a small increase year-on-year since 2019 (15% and 16% respectively).

As a result of the ONS revising occupational classification categories in 20209, teaching professionals now account for seven per cent of all freelancers whilst functional managers and directors account for five per cent.

Managers and proprietors have seen a decrease of 44 per cent since 2020 (equivalent to 93,000 individuals) and now account for seven per cent of all freelancers.

In addition, the newly revised sales, marketing and related associate professional occupations account for a further four per cent of all freelancers whilst sports and fitness occupations have seen a small increase since 2020, now accounting for five per cent of all freelancers.

Interestingly, therapy professionals and media professionals have both experienced increases of 29 per cent and 41 per cent respectively since 2020 with each occupational group now accounting for four per cent of all freelancers.

On the other hand, freelancers working within design occupations have dropped by 50 per cent since 2020 (equivalent to 42,000 individuals).

Gender

The UK’s freelance population is now comprised of 54 per cent males and 46 per cent females, representing a 2-percentage point increase in female freelancers since 2020. This represents a more even gender distribution than the overall UK solo self-employed population, which is 61 per cent male and 39 per cent female.

The number of highly skilled freelance women has decreased by six per cent since 2020 (equivalent to 58,000 individuals). Male freelancers, similarly, have seen a 14 per cent drop in numbers during the same period (equivalent to 169,000 individuals).

Looking at SOC groups more closely reveals that men continue to dominate in the top two highest SOC groups, where they represent 62 per cent of the highest SOC group compared to 38 per cent of women and 55 per cent of all professional occupations compared to 45 per cent of women.

There is now an even gender distribution in SOC3 associate professional and technical occupations, with men and women both representing 50 per cent of the third-highest SOC group.

Working mothers

The number of freelance mothers in the UK has seen a 14 per cent decrease since 2020. There are now 276,000 highly skilled freelancing mothers, accounting for 15 per cent of the total freelancer population.

SOC2 professional occupations are the only SOC group to experience an increase in the number of working mothers since 2020, rising by one per cent since 2020 (equivalent to 2,000 individuals).

On the other hand, the number of working mothers operating in SOC3 associate professional and technical occupations has decreased by 20 per cent since 2020 (equivalent to 30,000 individuals).

Similarly, the number of freelance mothers working as SOC1 managers, directors and senior officials has decreased by 30 per cent between 2020 and 2021 (equivalent to 18,000 individuals).

Age

The largest age groups for freelancers are those aged between 50-59 (493,000) and 40-49 (409,000). Combined, these groups account for 48 per cent of all freelancers. Consequently, the average age of UK freelancers is now 48 years old, the same as in 2020 and one year older than the overall solo self-employed average age for 2021.

Concerningly, as is the case with the overall solo self-employed workforce, the number of freelancers in every age group has decreased since 2020, except those aged between 16-29 which has actually increased by three per cent (equivalent to 12,000 individuals).

Those aged between 30-39 have seen the largest decrease since 2020, falling by 11 per cent (equivalent to 100,000 individuals) whilst freelancers aged between 40-49 have also decreased by 10 per cent since 2010 (equivalent to 92,000 individuals).

Similarly, freelancers aged over 60 have decreased by three per cent between 2020 and 2021 (equivalent to 27,000 individuals) whilst those aged between 50-59 have seen a small drop of one per cent in 2021 (equivalent to 9,000 individuals).

Length of time in self-employment

As is the case with the overall solo self-employed workforce, almost two-fifths of freelancers (39%) have been working in this way for over 10 years.

A further 21 per cent of freelancers moved into self-employment between 2014 and 2017 whilst 10 per cent have been operating in this way since between 2011 and 2013.

An additional 13 per cent have only made the move to freelancing between 2020 and 2021, equivalent to 199,000 new freelancers.

Benefits

Since our last report in 2020, there have been large decreases in the number of freelancers claiming almost all of the benefits apart from Universal Credit, with the number of freelancers claiming Universal Credit increasing by 34 per cent since 2020 (equivalent to 21,000 individuals).

This increase in those claiming Universal Credit is particularly concerning given that this follows the 345 per cent increase in the number of freelancers claiming Universal Credit between 2019 and 2020.

The greatest decrease in the number of freelancers claiming a benefit can be found in those claiming income support which has decreased by 59 per cent since 2020 (equivalent to 3,000 individuals).

Similarly, the number of freelancers claiming carer’s allowance since 2020 has decreased by 28 per cent (equivalent to 5,000 individuals) whilst those claiming tax credits has also decreased by 25 per cent (equivalent to 19,000 individuals).

Sickness or disability benefits have also seen a sharp decrease of 33 per cent since 2020 (equivalent to 15,000 individuals).

Location

Freelancers continue to have a similar geographical distribution to the overall solo self-employed workforce. However, a greater proportion of them live in London and the South East, with 22 per cent of freelancers living in London compared to 17 per cent of the overall solo self-employed workforce whilst 23 per cent of freelancers live in the South East compared to 22 per cent of the overall solo self-employed workforce.

The decreases in the number of solo self-employed workers throughout the country are largely echoed with the freelance population.

The West Midlands has seen the largest drop in freelance numbers since 2020, decreasing by 26 per cent (equivalent to 43,000 individuals).

Scotland, also, has experienced a 21 per cent decrease in the number of freelancers since 2020 (equivalent to 31,000 individuals) whilst the East Midlands has seen the third-largest decrease as a proportion, with the number freelancing in the region falling by 18 per cent (equivalent to 22,000 individuals).

London, despite being the most populous region for freelancers as a proportion, has seen the fourth-largest drop in numbers, decreasing by 16 per cent since 2020 (equivalent to 80,000 individuals).

On the other hand, Wales, since 2020, has actually seen a 44 per cent increase in the number of freelancers living in the region (equivalent to 27,000 individuals).

Similarly, Northern Ireland and Yorkshire and Humber have also seen small increases in the number of freelancers living in the region, increasing by five per cent and three per cent respectively.

Conclusion

The spread of the Alpha, Delta and Omicron variants and the continuation of COVID-19 restrictions in 2021 have had devasting consequences for the solo self-employed sector over the past year. The workforce has shrunk, with the number of self-employed workers falling 5 per cent from 4.3 million in 2020 to 4.1 million in 2021. The fall represents the second time that the sector has decreased since 2008 and shows that last year’s drop wasn’t a one-off fluke.

Instead, the decline of the solo self-employed workers is part of an ongoing reaction to COVID-19 uncertainty. While it is unclear whether the end of the pandemic will see a return to growth, it is likely that the fall in the number of self-employed workers will continue into 2022 until the country is safe from Omicron and other potential variants.

Furthermore, as shown by IPSE research late last year, changes to IR35 and off-payroll working in the private sector in April 2021 have created further uncertainty in the self-employed sector, with over a third of contractors (35%) claiming to have left freelance work since the reforms.

However, despite the doom and gloom, there are still reasons to be positive. Wales, the East of England and the North East have defied expectations by increasing the number of solo self-employed in their regions, more women and disabled people have entered into the sector, and SOC8 (process, plant and machine operative occupations) and SOC7 (sales and customer service occupations) workers have both grown over the past year.

While the increase in certain areas and groups aren’t enough to make up for the fall in numbers throughout the industry, they show that there is still life within the freelancing sector and that self-employed work continues to be a viable and positive option for many.

These bright spots, however, aren’t enough to solve the sector’s problems going into 2022. Solo self-employment, while historically one of the most dynamic and resilient parts of the workforce, has been undermined and damaged throughout the COVID-19 crisis and without proper government support won’t be able to flourish and drive recovery.

Appendix

Latest news & opinions

IPSE's Josh Toovey explains why 2026 could bring renewed opportunity for the self-employed after a tough 2025 of limited projects and rising costs.

The festive season is a chance to celebrate another year of hard work, thank clients and colleagues, and relax after filing your tax returns for the last financia...

If you’re running a business, the festive season is often a busy time with client projects to finish, tax returns to submit, and plans to make for the following y...