The Self-Employed Landscape 2022

Our report for 2022 provides a snapshot of how the sector’s size, demographics and economic impact have changed in the past year.

Executive Summary

- The solo self-employed workforce contributes an estimated £278bn a year to the UK economy

- The number of working mothers in self-employment has increased by 55 per cent since 2008

- Since 2013, the overall solo self-employed disabled population has increased by 42 per cent

Regionally, London, Scotland and Northern Ireland have seen increases in their solo self-employed population since 2021

The research reveals that the solo self-employed sector contributes an impressive, estimated figure of £278 billion to the UK economy per year. Moreover, highly skilled freelancers (SOC1, SOC2 and SOC3) are estimated to provide approximately £126 billion of the £278 billion that solo self-employed workers generate – accounting for 45 per cent of the overall contribution.

Along with the impressive economic contribution, the report revealed that the number of working mothers in self-employment has increased by 55 per cent since 2008, now accounting for 13 per cent of all solo self-employed people (549,000 individuals). Exactly half (50%) of working mothers are now working in the top three highest skilled occupations (SOC1, SOC2 and SOC3).

Similarly, the research also found that the overall solo self-employed disabled population has been increasing year-on-year since 2013, increasing by 42 per cent during this time. Interestingly, the age group that has seen the highest increase amongst the disabled solo self-employed is the 60+ age band, experiencing an increase of 28 per cent between 2021 and 2022 – equivalent to 47,000 individuals.

Released annually, the IPSE Self-Employed Landscape report provides a snapshot of how the past year has impacted the sector, reviewing both the solo self-employed (self-employed individuals who do not have employees) and freelancers (those operating in the top three SOC groups).

Regionally, Northern Ireland (13%), London (10%), Scotland (10%), and South West England (9%) have seen increases in their solo self-employed population since 2021. Whilst Wales (-17%), the East of England (-9%), North East England (-9%), North West England (-6%), the West Midlands (-5%) and the East Midlands (-4%) reported decreases.

The report also reviewed the major occupations of the solo self-employed workforce, with the UK’s self-employed predominantly working in construction and building trades (360,000), as road transport drivers (284,000), in artistic, literary and media occupations (274,000), or in agricultural and related trades (189,000).

Introduction

The self-employment sector has slowly started to recover over the past year after previous factors and periods of uncertainty, restrictions and reforms. However, freelancers have been contending with the continuing impact of the off-payroll working (IR35) reforms which came into effect in April 2021 whilst also challenged by the cost-of-living crisis that has engulfed the UK throughout much of 2022.

IPSE’s own research has revealed that as a result of the changes, one in three contractors (36%) are now working in engagements that are deemed ‘inside IR35’ and of those working inside-IR35 contracts, 80 per cent have seen a drop in their quarterly earnings and by an average of 30 per cent.[1]

Similarly, our survey of freelancers on the cost-of-living crisis revealed that over half (50.4%) strongly believe that their day rates won’t be able to keep up with rising inflation.[2] Freelancers were also worried about incurring debt (27.2%) and covering mortgage repayments (23.8%) during the cost-of-living crisis. As a result, one in four freelancers (25%) reported that they were considering leaving self-employment in the next 12 months due to the current pressures of the cost-of-living crisis.

This report examines two subsets of the overall self-employment sector: the solo self-employed – those who are self-employed but do not employ others – and freelancers – those who are working in the top three highest skill occupational categories (SOC1 to SOC3). From analysis of the ONS Labour Force Survey (LFS) data from Q2 2022, the report will review demographics and highlight any changes to the sector over the last year.

UK's Solo Self-Employed

Who are they?

In this first section, we explore the UK’s solo self-employed population in more detail using data from the second quarter of the Labour Force Survey in 2022, 2022 and 2008. The solo self-employed are defined as individuals who are running their own business, operating as a sole trader or in a partnership and do not have any employees.

Following two successive years on a downward trend, this year the number of solo self-employed people in the UK has remained stable at 4.1 million people, with 2.8 million of these operating as sole traders - accounting for 63 per cent of the entire UK solo self-employed workforce.

It is now encouraging that the UK’s solo self-employed population has remained stable compared to 2021. Looking ahead, this now renews hope that the sector could begin to grow and return to its year-on-year growth experienced between 2008 and 2019 which was largely driven by the expansion of the freelance sector. Freelancers are a subsection of the solo self-employed that includes highly skilled managers, directors, professionals and associate/technical professionals.

Contribution

Despite the population figures remaining relatively stable, the solo self-employed population contribute an estimated £278 billion to the UK economy.

Interestingly, this represents a decrease on our findings from 2021, where the solo self-employed contributed an estimated £303 billion a year. With the overall population figures remaining stable, the current estimate is based on a lower average turnover for solo self-employed businesses. This can be attributed to a multitude of factors, such as the fact that the IR35 reforms have reduced income, government tax policy towards the sector and the fact that freelance businesses now have higher overheads as a result of increasing inflationary pressures.

Skill profile

The skill profile of the UK’s solo self-employed is based on the Standard Occupational Classifications (SOCs), an internationally recognised system that classifies occupations according to the skill level required for them.3 There are currently nine major levels of SOC codes ranging from managers, directors and senior officials at the top end to elementary occupations in SOC9, which generally require a minimum level of education.

It's been a mixed picture in terms of changes in the size of SOC groups within the solo self-employed population, with decreases reported by some SOC groups counteracted by increases in other occupational groups. The greatest decrease in numbers has been seen in SOC7 Sales and Customer Service Occupations, decreasing by nine per cent between 2021 and 2022.

SOC3 Associate professional and technical and SOC9 elementary occupations also experienced a decrease between 2021 and 2022, falling by five per cent and four per cent respectively.

Similarly, SOC5 Skilled Trades Occupations also fell since 2021, decreasing by three per cent in that time.

On the other hand, SOC6 Caring, Leisure and Other Service Occupations experienced the greatest increase in numbers, increasing by nine per cent between 2021 and 2022.

In addition, SOC8 Process, Plant and Machine Operatives and SOC2 professional occupations have both experienced increases since 2021, increasing by seven and six per cent respectively.

SOC4 Administrative and Secretarial Occupations have also fallen by 2 per cent whereas SOC1 managerial occupations have remained stable in size since 2021.

Freelancers now account for 46 per cent of the overall solo self-employed population which represents a one percentage point increase compared to 2021.

The group with the highest number of solo self-employed people remains SOC5 skilled trades occupations including sectors ranging from construction and agriculture to textiles and food preparation. This group accounts for 24 per cent of the total solo self-employed population and has remained relatively stable for the past two consecutive years.

Top Occupations

In the one to nine major SOC groups there are 90 minor occupational groups. Looking closely at these can give a more detailed understanding of the kinds of roles solo self-employed people are working in.

Similar to previous years, the highest proportion of the UK’s solo self-employed are working in the construction and building trades (360,000), as road transport drivers (284,000), in artistic, literary and media occupations (274,000), or in agricultural and related trades (189,000).

However, the number of solo self-employed people working in construction and building trades has decreased by two per cent. This follows a 10 per cent decrease experienced between 2020 and 2021.

Interestingly, the number of solo self-employed people working as road transport drivers has increased by three per cent whilst, encouragingly, those operating in artistic, literary and media occupations has increased by six per cent.

Similarly, the number of solo self-employed people working in agricultural and related trades has also increased, increasing by two per cent since 2021.

Gender

The gender distribution of the UK’s self-employed workforce remains uneven and after two successive years of the population swinging in favour of women, this year we see that the population has swung in favour of men. The overall solo self-employed population is now 62 per cent male and 38 per cent female, representing a one percentage point increase in the proportion of men compared to 2021.

Overall, there was a drop of two per cent in the number of solo self-employed women compared to a drop of one per cent in the number of men.

Looking at the long-term trend reveals that the number of men has increased by 11 per cent since 2008 whilst the number of women has increase by 57 per cent over the same timeframe.

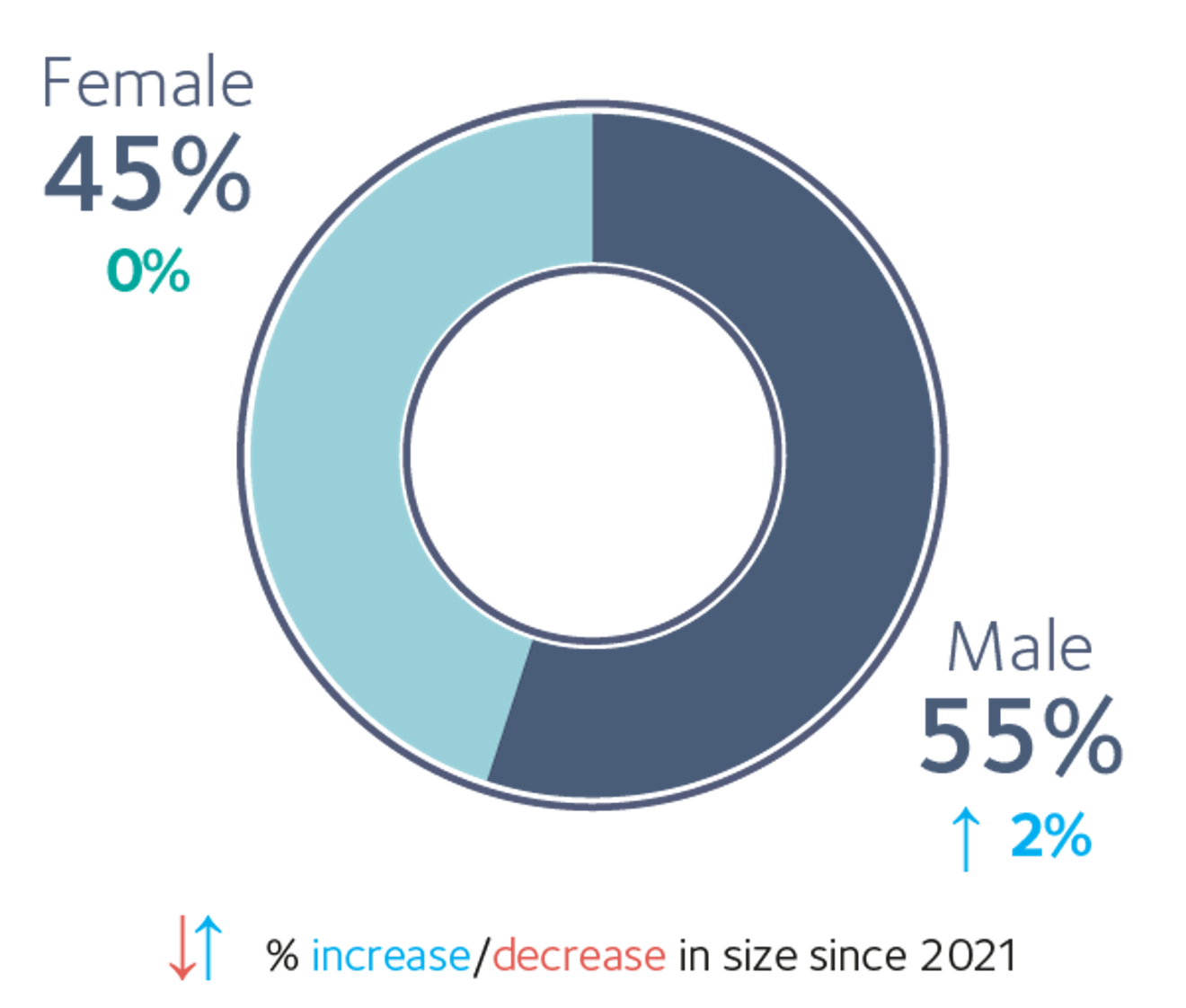

When reviewing the higher occupational categories (SOC1 to SOC3), there is a more even gender distribution, with men making up 55 per cent of all freelancers and women 45 per cent of the population.

Men continue to dominate in most of the occupational categories, such as in SOC5 skilled trades occupations (89%), SOC8 process, plant and machine operatives (89%) and in SOC1 managerial occupations (64%).

On the other hand, women dominate SOC6 caring, leisure and service occupations (79%) and SOC4 administrative and secretarial occupations (78%).

The lowest proportion of females can be found in SOC5 skilled trades occupations (11%) and in SOC8 process, plant and machine operatives (11%).

Working Mothers

There are now a total of 549,107 solo self-employed mothers, which represents 13 per cent of all solo self-employed people. Exactly half (50%) of working mothers are now working in SOC1 to SOC3 highly skilled occupations.

The total number of solo self-employed mothers has increased by four per cent since 2021 and looking at the long-term trend, the number of working mothers has increased by 55 per cent since 2008.

Self-employed mothers are now most likely to be working in SOC6 caring, leisure and other service occupations (106,000) SOC2 professional occupations (105,000) and SOC3 associate professional and technical occupations (101,000).

Interestingly, since 2021, the number of solo self-employed mothers working in SOC9 elementary occupations has increased by 24 per cent.

On the other hand, the number of solo self-employed mothers working in Process, Plant and Machine Operatives has fallen by 22 per cent since 2021.

Age

The average age of the UK’s solo self-employed is now 48 years old, which represents a small increase on 2019 and 2020, where it stood at 47 years old. Similar to our reports in 2019, 2020 and 2021, the largest age groups in 2022 are 50-59 years (1,082,000) and 40-49 years (944,000). When taken together, these two groups account for exactly half of the whole solo self-employed population (50%).

The smallest proportion of the solo self-employed workforce can be found in the 16-29 years age group, accounting for just 11 per cent of the sector.

Two groups have seen the largest proportional drop in numbers between 2021 and 2022, with both 16-29 years and 30-39 years falling by seven per cent.

On a more positive note, both 60+ years and 40-49 years have increased in size since 2021, increasing by seven per cent and five per cent respectively.

Length of time in self-employment

Now looking at the length of time that the UK’s solo self-employed workforce have been in self-employment reveals that 41 per cent have been working in this way for over ten years. This figure has remained the same since our report in 2021 and also closely aligns with previous research revealing that those entering self-employment do so for overwhelmingly positive reasons4 – clearly entering self-employment for the long run.

Interestingly, 26 per cent of the solo self-employed workforce have been in self-employment since 2019 – equating to 961,000 self-employed individuals – whilst a further 21 per cent entered self-employment between 2015 and 2018.

An additional 10 per cent of the solo self-employed workforce began operating as self-employed since between 2012 and 2014.

Notably, 13 per cent of the solo self-employed population have been operating in this way since 2021, equivalent to 486,000 newly self-employed individuals.

Disability

The number of solo self-employed people in the UK who were considered disabled under the Equality Act 2010 has been increasing year-on-year since 2013, increasing by 42 per cent during this time.

In fact, 21 per cent of disabled people reported that they had made the move into self-employment for better work or job satisfaction.[1]

After last year’s report revealed there had been a seven per cent increase in the number of solo self-employed disabled people between 2020 and 2021, this year’s figures now show a two per cent increase in the number of solo self-employed disabled.

In comparison, the number of disabled employees has increased by 11 per cent during the same period (2021 to 2022).

The two per cent increase in the number of solo self-employed disabled is largely driven by an increase in the number of female disabled self-employed operating in the UK, with this group experiencing a 4 per cent increase since 2021.

The age group that has seen the highest increase amongst the solo self-employed disabled is the 60+ age band, experiencing an increase of 28 per cent since 2021 (equivalent to 47,000 individuals).

Benefits

The Labour Force Survey also asks respondents to indicate whether they were claiming any state benefits or tax credits during a specific one-week period in the quarter.

Now looking at the data for Q2 2022 reveals that the number of solo self-employed claiming benefits has decreased by two per cent between 2021 and 2022. This follows a five per cent decrease between 2020 and 2021.

Since 2021, there has been a 21 per cent increase in the number of solo self-employed people claiming pension benefits such as state pension or pension credit – in line with our findings from this year’s report where the 60+ age group has seen the largest increase over the past year.

Encouragingly, the number of solo self-employed people claiming universal credit has decreased by 19 per cent over the past year whilst the number claiming tax credits has reduced by 27 per cent.

Just five per cent of the solo self-employed population are claiming Universal Credit in 2022.

On the other hand, the number of solo self-employed people claiming child benefit has actually increased by four per cent in the past 12 months.

Location

The solo self-employed continue to be found in all regions of the UK, but most prominently concentrated in the South East (21%), London (19%) and the South West (10%). When taken together, these areas account for over half of the entire sector (51%).

Interestingly, Wales experienced the largest decrease in solo self-employed numbers, falling by 17 per cent over the last 12 months whilst the North West also experienced a decrease of six per cent.

In addition, the West Midlands and the East Midlands experienced decreases in their solo self-employed population of five per cent and four per cent respectively.

The South East also saw it’s solo self-employed population decrease by two per cent since 2021.

On the other hand, Northern Ireland reported the largest increase in their self-employed population over the last 12 months, increasing by 13 per cent over this timeframe – equivalent to 10,000 additional self-employed individuals operating in this area.

London and the South West also experienced an increase in their solo self-employed population over the previous 12 months, increasing by 10 per cent and nine per cent respectively. London’s increase in solo self-employed numbers is equivalent to 71,000 additional self-employed individuals now operating in this area.

Similarly, the overall number of solo self-employed operating in Scotland has increased by 10 per cent over the past year.

The UK's Freelance Workforce

Freelancers are a subsection of the solo self-employed population who are working in the top three highest skilled occupational categories (SOC1 to SOC3). This subsection includes highly skilled managers, directors, professionals and associate/technical professionals, including occupations from lawyers and accountants, doctors and scientists, to writers and designers.

There are now 1.9 million freelancers in the UK, up one per cent from 2021. The number of freelancers as a proportion of the overall solo self-employed population has remained at 46 per cent – the same figure as our findings in 2021.

Contribution

Previous research has shown that freelancers play a critical role in the economy by enabling businesses to manage and reduce entrepreneurial risk, enable the de-risking of uncertainties in the market and reduce the amount of finance required for innovation and business start-ups; ultimately promoting innovation, enterprise and growth.6

Whilst there are no official statistics directly measuring freelancers’ contribution to the economy, it is, however, possible to provide a speculative estimate. If freelancers’ contribution to turnover is proportionate to their presence in the wider group of businesses without employees, their collective sales would be approximately £126 billion. This would comprise 45 per cent of the £278 billion contributed by the UK’s wider solo self-employed workforce.

This figure could be even higher as freelancer-owned businesses may be expected to generate greater revenue than businesses in the lower-skilled occupational categories because of their level of knowledge and skill. Their contribution to the UK economy in 2022 could even be as high as £139 billion.

Skill profile

The largest group of freelancers, accounting for 820,000 individuals and 43 per cent of all freelancers, are those working in SOC2 professional occupations. This figure represents an increase of seven per cent since 2021, where 762,000 individuals were working within this SOC code but it also represents a 98 per cent increase in overall numbers for this SOC code since 2008.

SOC3 associate and professional freelancers have experienced a five per cent decrease since 2021, now accounting for 702,000 individuals. However, this SOC code has still experienced an increase of 12 per cent since 2008.

SOC1 managerial freelancers have remained stable over the past year, continuing to account for 365,000 individuals. This represents a two per cent increase for this SOC code since 2008.

Top occupations

Now looking across the occupational categories in more detail reveals that occupations across the sector have been affected in different ways between 2021 and 2021.

The largest occupational group for freelancers remains those operating in artistic, literary and media occupations which now account for 17 per cent of all freelancers (321,000 individuals) after seeing a small percentage-point increase year-on-year since 2019 (15% and 16% respectively).

Teaching professionals now comprise eight per cent of all freelancers (158,000 individuals) whilst managers and proprietors in other services account for six per cent of all freelancers (119,000 individuals).

In addition, functional managers and directors account for five per cent of all freelancers (114,000 individuals) whilst sales, marketing and related associate professionals now represent five per cent of all freelancers (86,000 individuals).

Similarly, sports and fitness occupations now account for four per cent of all freelancers (76,000 individuals whilst therapy professionals also account for four per cent (70,000 individuals).

Looking at how these occupations have changes across the last year reveals that the number of freelance teaching professionals has seen the highest increase since 2021, increasing by 16 per cent.

Functional managers and directors have also seen an increase in the number of freelancers operating within the occupation, increasing by 14 per cent over the last year.

Furthermore, therapy professionals, artistic literary and media occupations and sales, marketing and related associate professionals have all seen small increases on last year’s report, increasing by 4 per cent, 3 per cent and 3 per cent respectively.

Functional managers and directors, on the other hand, have seen a small decrease in their overall numbers, falling by one per cent since 2021.

Gender

The UK’s freelance population is now comprised of 55 per cent males and 45 per cent females, representing a one percentage point swing in favour of male freelancers since 2021. This represents a more even gender distribution than the overall UK solo self-employed population, which is 62 per cent male and 38 per cent female.

The number of highly skilled freelance men has increased by two per cent since 2021 – equivalent to 20,000 individuals – whereas the number of highly skilled freelance women has remained stable since last year.

Looking at SOC groups more closely reveals that men continue to dominate the top two highest skilled SOC groups, where they comprise 64 per cent of the SOC1 managerial freelancers compared to 36 per cent per cent of women.

Similarly, men represent 54 per cent of SOC2 professional freelancers compared to 46 per cent of women whereas SOC3 associate professional and technical freelancers is more even in terms of gender distribution, with men comprising 51 per cent and women 49 per cent.

Working mothers

The number of freelance mothers in the UK has seen a three per cent increase over the last 12 months, equivalent to 7,000 additional freelance mothers.

There are now 280,000 highly skilled freelancing mothers in the UK, accounting for 15 per cent of the total freelancer population.

Both SOC2 professional freelancers and SOC3 associate professional and technical freelancers experienced an increase in the number of working mothers, with both increasing by four per cent since 2021 (equivalent to an additional 5,000 individuals for both).

SOC1 managerial freelancers, on the other hand, experienced a decrease in their overall numbers of working mothers, decreasing by six per cent over the past year (equivalent to 2,000 individuals).

Age

The largest age groups for freelancers are those aged between 50-59 (477,000) and 40-49 (457,000), with these age groups comprising 25 per cent and 24 per cent of all freelancers. Combined, these age groups account for half of all freelancers (50%). Consequently, the average age of UK freelancers is 49 years old, which is one year older than the overall solo self-employed average age.

Both 30-30 years and 50-59 years have seen decreases in the number of freelancers operating within these age groups since last year, falling by 17 per cent (equivalent to 65,000 individuals) and four per cent (equivalent to 19,000 individuals) respectively.

On a more positive note, the 40-49 years age band has grown over the last year amongst freelancers, increasing by 12 per cent since 2021 (equivalent to 48,000 individuals).

Similarly, both the 60+ and 16-29 years age groups have also increased over the last 12 months, increasing by seven per cent (equivalent to 29,000 individuals) and 13 per cent (equivalent to 23,000 individuals) respectively.

Interestingly, those aged 60+ now represent over a fifth of the freelance population (23%).

Length of time in self-employment

Now looking at the length of time that the UK’s freelance workforce have been in self-employment reveals that over half (51%) have been operating in this way for over 10 years. This represents a sharp increase on our report from 2021 – where just 39 per cent of freelancers had been working in this way for over 10 years.

Interestingly, 31 per cent of the freelance workforce have been in self-employment since 2019 – equating to 594,000 self-employed individuals – whilst a further 27 per cent entered self-employment between 2015 and 2018.

A further 14 per cent of the freelance workforce have been operating in this way since between 2012 and 2014.

Benefits

Since our last report in 2021, there have been large decreases in the number of freelancers claiming almost all of the benefits apart from pension benefits (including state pension or pension credit), which has seen an 18 per cent increase on 2021 (equivalent to 29,000 additional claimants). This is likely linked to the slight increase in the average age of freelancers, with more freelancers now qualifying for such benefits.

Encouragingly, after a 34 per cent increase between 2020 and 2021 and a 345 per cent increase between 2019 and 2020, the number of freelancers claiming Universal Credit has now fallen by 37 per cent since 2021 (equivalent to 31,000 fewer claimants).

Similarly, the number of freelancers claiming tax credits and the number of freelancers claiming housing or council tax reduction has also fallen over the last year, decreasing by 36 per cent (equivalent to 20,000 fewer claimants) and 32 per cent (equivalent to 13,000 fewer claimants) respectively.

In addition, the number of freelancers claiming sickness or disability benefits has fallen by 11 per cent since 2021 (equivalent to 4,000 fewer claimants).

The number of freelancers claiming child benefit has remained stable over the last year, with 206,000 freelancers continuing to access this support.

Location

Freelancers continue to have a similar geographical distribution to the overall solo self-employed workforce.

Much like the overall solo self-employed workforce, a significant proportion of freelancers live in London (24%) and the South East (22%) – which closely follows our findings for the overall solo self-employed (19% and 21% respectively).

Northern Ireland and Wales, which comprise two and four per cent of the freelance workforce respectively, have experienced the sharpest decreases in overall freelancer numbers for the last 12 months, falling by 19 per cent and 17 per cent respectively.

Similarly, the East Midlands has also seen a drop in the number of freelancers operating in this area, decreasing by seven per cent over the last year and now comprising five per cent of the overall freelance workforce.

The East of England, which represents three per cent of all freelancers, has also experienced a drop in numbers since 2021, decreasing by four per cent over the last year.

Despite representing over a fifth of the freelance population (22%), the South East has also seen a small decrease in overall freelance numbers since 2021, decreasing by two per cent over that timeframe.

Interestingly, London (24%) and Scotland (7%) have seen the largest increases in the number of freelancers operating in these areas, both increasing by eight per cent in the past 12 months.

In addition, the North West has also experienced an increase in the freelance population, increasing by five per cent and now comprising eight per cent of all freelancers.

The West Midlands and the South West have also both seen an increase in the number of freelancers operating in these areas, increasing by two per cent and three per cent respectively. The West Midlands now comprises seven per cent of the freelance population whilst the South West represents 10 per cent.

Conclusion

The research now reveals the impressive contribution that the solo self-employed continue to provide to the economy, with the estimate totalling £278 billion to the UK economy per year. Moreover, highly skilled freelancers (SOC1, SOC2 and SOC3) are estimated to provide approximately £126 billion of the £278 billion that solo self-employed workers generate – accounting for 45 per cent of the overall contribution.

Despite overall numbers of the solo self-employed remaining stable compared to 2021, the research reveals disparities across the UK’s regions. Whilst Northern Ireland, London and Scotland experienced increases in their total solo self-employed population, Wales saw a sharp drop in their population over the last 12 months.

With the report also revealing significant increases in the number of mothers and disabled opting for the flexibility and greater work-life balance afforded by freelancing, it’s time government embraces this sector and these groups by incentivising rather than disincentivising self-employment.

Self-employment remains one of the most dynamic and prosperous parts of the economy, yet government policy towards this sector has not reflected the significant contribution that is provided to clients and the wider UK economy.

Latest news & opinions

IPSE's Joshua Toovey outlines the top five tax tips for the self-employed so you can get ahead of next year's tax year end.

Following a ruling that four sports broadcasters broke rules on coordinating their freelancers' pay, IPSE's Fred Hicks looks at the options for levelling the play...

IPSE's Joshua Toovey runs through the key announcements for the self-employed at the 2025 Spring Statement.