Freelancer Confidence Index Q2 2021

Our report tracks key trends in the market for freelancers in order to identify inflationary pressures, business confidence, and an overview of freelancers’ perception of general economic conditions for Q2 2021.

Executive Summary

- Freelancers’ 12-month confidence in their businesses has increased to its highest level since 2015

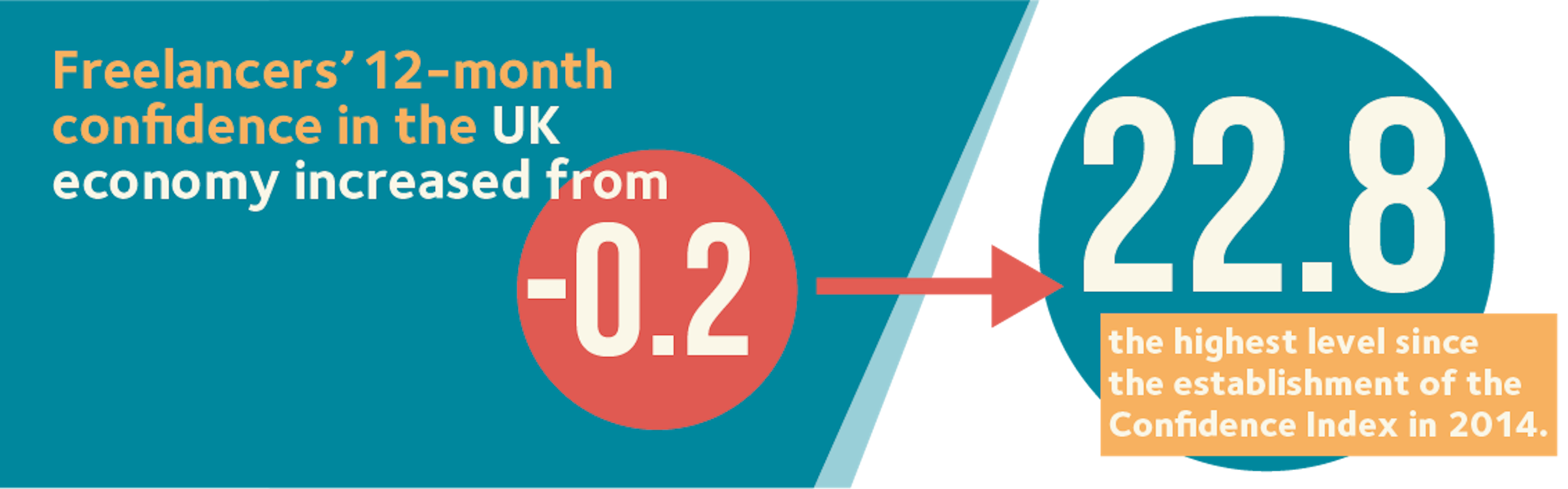

- Freelancers’ 3-month and 12-month confidence in the economy has reached the highest level since 2014

- However, average freelancer earnings are lagging behind – and even fell by £2,126 in Q2

Many freelancers are slashing their day rates seemingly to compete for fewer contracts after the changes to IR35 self-employed tax regulations

Freelancers’ confidence in their businesses and the economy is surging, but when it comes to their earnings, reality is not yet meeting expectation. Freelancers’ 3-month and 12-month confidence in the wider economy has now reached the highest level since 2014, when the Confidence Index began. They are now also more confident about their business performance over the next three months than they have been since 2018. And their 12-month business confidence has surged to levels not seen since 2015.

While confidence is surging, however, quarterly earnings are not keeping pace. In fact, after a jump to £20,778 amid the optimism of the first quarter of 2021, average freelancer earnings have now fallen sharply to £18,652.

This £2,126 drop is driven not by a decrease in work (spare capacity – the number of weeks freelancers do not work per quarter – stayed at 3.7 weeks), but by freelancers themselves reducing their day rates. Average freelancer day rates fell from £445 to £397 – lower than during the pandemic and their lowest level since 2018.

The slash in day rates was overwhelmingly driven by SOC1 managerial freelancers (£579 down to £451) and SOC2 professional freelancers (£546 down to £476). This suggests a key factor here may be the government changes to IR35 self-employed tax regulations, which affect these two groups the most. Faced with the changes to IR35, many client organisations are ceasing to engage contractors. Therefore, it may be that freelancers in these groups are slashing their day rates to compete for a diminished pool of contracts.

This is supported by the fact that SOC1 and SOC2 freelancers were also the most likely to say government tax policy relating to freelancers was one of the biggest factors negatively affecting their business (60.0% of SOC1 freelancers cited this, just below the 61.4% who cited the pandemic; among SOC2 freelancers it was by far the biggest factor, picked by 71.8% - followed by government policy relating to hiring freelancers, which was cited by 67.4%).

The fact that 3- and 12-month business confidence remains so high among freelancers despite flagging earnings suggests that even SOC1 and SOC2 freelancers, who are now battling it out over fewer contracts, expect this chaotic situation to right itself and stabilise in the longer term. This may explain why their 12-month business confidence is higher than their 3-month business confidence.

As the economy opens up, though, and the prospect of inflation looms, freelancers are, however, expecting their business costs to increase over the coming year. 68 per cent of freelancers expect their business input costs to increase over the coming year – by an average of 11.1 per cent.

Recent Confidence Index surveys have also begun tracking freelancers’ stress levels and job satisfaction – by asking freelancers to rate both on a scale of 0-10. This now shows that – as may be expected – job satisfaction reached record lows and stress reached record highs in 2020. Now, however, job satisfaction has recovered from a nadir of 5.13 in Q3 2020 to 5.88 in Q1 2021 and 5.85 in Q2. Meanwhile, stress has fallen from a peak of 6.63 in Q1 2020 to 5.77 in Q1 2021 and 5.58 in Q2.

Business Confidence

With Coronavirus restrictions beginning to ease, more sectors beginning to reopen and the vaccination roll-out continuing at a fast pace, freelancers’ confidence in their own businesses could be expected to pick up. In fact, after suffering a small decrease between Q4 2020 and Q1 2021 (from -11.9 to -13.9), the three-month freelancer business confidence index has increased to 8.2, the first positive level since Q2 2019 (3.5) and the highest confidence rating since Q2 2018 (8.4).

The Q2 2021 Confidence Index reflects both the period after the implementation of the IR35 reforms in April and the announcement of a delay to the 21 June ‘Freedom Day’ to 19 July. Yet, despite this and the small decrease in confidence reported between Q4 2020 and Q1 2021, freelancers' business confidence has inflated to its highest level for several years.

Looking at freelancers’ confidence in their businesses over the next three months in more detail reveals that there were increases in confidence across all three SOC groups and positive levels across the three occupational categories for the first time since Q1 2018. SOC1 managerial freelancers’ confidence increased from -16.7 in Q1 2021 to 15.9 in Q2 2021 and SOC3 associate professional and technical freelancers’ confidence increased from 4.3 to 7.6 in the same period. However, it was SOC2 professional freelancers who saw the biggest rise during this time, increasing from -31.7 to 3.6.

Between Q4 2020 and Q1 2021, business confidence for the next 12 months had stagnated at -15.6, largely driven by falling business confidence amongst SOC1 managerial freelancers. This quarter, we now see a sharp increase in the average 12-month business confidence, increasing to 13.3 in Q2 2021. This represents the highest index level for 12-month business confidence since Q2 2015 (15.8).

Similar to the three-month confidence levels, all three SOC groups saw increases in their 12-month confidence levels since the previous quarter and returned positive scores. Between Q1 2021 and Q2 2021, SOC2 professional and SOC3 associate professional and technical freelancers saw increases from -34.6 to 3.5 and 10.7 to 19.2, respectively. However, it was SOC1 managerial freelancers that experienced the largest increase in 12-month confidence, from -29.5 in Q1 2021 to 18.5 in Q2 2021.

Factors Impacting Business Performance

Firstly, looking at the factors that have negatively impacted freelancers' business performance in Q2 2021 reveals some interesting changes from Q1 2021. Our findings in Q1 2021 indicated that concerns around the Coronavirus pandemic were dissipating, however in Q2 2021, the Coronavirus pandemic (60.6%) is once again the most cited factor negatively affecting freelancers’ business performance.

The fact that the Coronavirus pandemic has now returned to the top factor lowering freelancers’ business performance for the first time since Q4 2020, suggests that the delay to the easing of restrictions and to the reopening of the economy has been acutely damaging to freelancers’ businesses.

Although government tax policy relating to freelancing was the second most selected factor, the proportion of freelancers selecting this has decreased from 68.5 per cent in Q1 2021 to 54.9 per cent this quarter. Similarly, in Q1 2021, government regulation relating to hiring freelancers (72.9%) was the most cited factor negatively affecting freelancers’ business performance, whereas in Q2 2021, it is now cited as the third factor for lowering freelancers’ business performance (50.9%).

Government tax policy relating to freelancing continues, however, to have a detrimental effect on many freelancers’ businesses, in fact, looking at SOC 2 professional freelancers, 71.8 per cent cite this as a negative influencer. This is most likely due to the implementation of IR35 changes and the question of how to continue securing contracts ‘outside IR35’.

For SOC1 managerial and SOC3 associate professional and technical freelancers, the top factor this quarter was the Coronavirus pandemic (61.4% and 60.4% respectively). For SOC2 professional freelancers, the Coronavirus pandemic (60.4%) was the third most selected factor negatively affecting their businesses, behind government tax policy relating to freelancing (71.8%) and government regulation relating to hiring freelancers (67.4%).

With all three SOC groups selecting the Coronavirus pandemic in their top three overall factors negatively affecting their businesses and 60.6 per cent of all freelancers citing this as the main factor lowering business performance, the delay to the easing of restrictions has clearly had a damaging impact on freelance businesses.

Top factors which enhance freelancers' business performance

Turning to the positive factors influencing freelancers’ business performance reveals that whilst all the negative factors were external, the factors enhancing freelancers’ business performance remain largely internal. This quarter, the top two factors positively impacting freelancers’ businesses remain unchanged from previous quarters with the importance of brand value and reputation (63.3%) continuing to be the top factor enhancing freelancers’ businesses. The second factor most positively affecting business performance was innovation in terms of the services offered to clients, with 57.2 per cent selecting this. This was followed by collaboration with other freelancers/businesses to secure more work (54.4%). Collaboration was particularly important for SOC1 managerial freelancers with 63.4 per cent rating it as a positive factor.

Looking at positive influences in more detail reveals that SOC2 professional and SOC3 associate professional and technical freelancers both cited brand value/reputation as the most enhancing factors to their freelance business performance (60.4% and 66.3% respectively). SOC1 managerial freelancers, on the other hand, cited innovation in terms of better processes and operations (65.0%) as their most enhancing factor.

Innovation in terms of the services I offer to clients was selected by 52.5 per cent of SOC2 professional and 59.7 per cent of SOC3 associate professional and technical freelancers as having a positive impact on their business performance. For SOC2 professional freelancers, the adoption of flexible working practices by organisations was also an important factor enhancing business performance cited by 62.0 per cent.

Overall, we can see that the success of freelancers’ businesses is largely attributed to adopting the right business strategies with all three positive factors cited by freelancers to do with their strategies in securing work. Most importantly, brand value and reputation in the market continues to positively enhance freelancers’ business performance across all SOC groups.

Freelancer UK Economy Confidence Index

Much like confidence in their own freelance businesses, confidence in the UK economy has also significantly benefited from the upcoming easing of restrictions, with sectors beginning to reopen and the vaccination roll-out continuing at a fast pace. In fact, freelancers’ confidence in the UK economy over the next three months is now at 16.8, its highest point since the establishment of the Confidence Index in 2014, the first positive score since Q4 2015 and a strong increase from Q1 2021 (-4.3).

The record high levels of confidence in the UK economy echoes recent findings on consumer confidence in the UK, which saw its highest jump in confidence on record as a result of the planned easing of restrictions and the continued fast pace of the vaccination roll-out.1

SOC1 managerial freelancers saw the biggest increase – from -15.4 in Q1 2021 to 23.9 this quarter: the highest figure recorded for this group since Q4 2015 (31.3). SOC2 professional freelancers also saw a significant rise from last quarter, increasing from -8.7 in Q1 2021 to 14.0 this quarter, the first positive score for this group since Q2 2015 (15.3).

SOC3 associate professional and technical freelancers experienced the smallest increase from last quarter (from 6.7 in Q1 2021 to 14.9 this quarter), but they still recorded their highest index score since the establishment of the Confidence Index in 2014. The fact that all three SOC groups increased and produced the highest levels seen since at least 2015 could be ascribed to the prospect of restrictions lifting on 19 July.

When looking at freelancers’ confidence in the UK economy over the next 12 months, we see an almost identical picture to our findings on three-month confidence. Again, there was a significant increase in average confidence – rising from -0.2 in Q1 2021 to 22.8 this quarter, and like the three-month outlook, this now represents the highest index score since the establishment of the Confidence Index in 2014.

SOC1 managerial freelancers saw the biggest increase, jumping significantly from -15.8 in Q1 2021 to 43.5 in Q2 2021 and now representing the highest score for this group since the establishment of the Confidence Index in 2014.

SOC2 managerial freelancers experienced the second biggest increase on the last quarter (from -2.0 in Q1 2021 to 21.1 this quarter), which also represents the highest score for this SOC group since the establishment of the Confidence Index in 2014.

Although SOC3 associate professional and technical freelancers saw the biggest increase between Q4 2020 and Q1 2021, this quarter they only experienced a small increase from 11.3 in Q1 2021 to 11.5 in Q2 2021. This also represents the highest score for this SOC group since the establishment of the Confidence Index and as such, reveals that all three SOC groups reported record high levels of confidence in the UK economy over the next 12 months.

Freelancer Day Rates

Despite increasing confidence across the board, freelancer’s day rates have decreased by 11 per cent since Q1 2021 with average day rates now standing at £397 compared to £445 in Q1 2021. Average day rates have now fallen to their lowest level since Q3 2018, representing a disappointing drop after recovering in Q1 2021 (£445) from the slump experienced throughout the pandemic.

SOC1 managerial freelancers saw the biggest decrease in day rates, falling from £579 in Q1 2021 to £451 in Q2 2021. SOC2 professional freelancers also saw a significant drop in day rates from £546 in Q1 2021 to £476 this quarter.

SOC3 associate professional and technical freelancers, however, experienced a small increase in their day rates from £268 in Q1 2021 to £292 in Q2 2021.

The decreases in SOC1 managerial and SOC2 professional freelancers’ day rates can be largely attributed to the implementation of the IR35 changes with greater competition as a result of contractors seeking a diminishing number of ‘outside IR35’ contracts conceivably impacting on freelancers’ negotiating power and as such, average day rates.

Looking ahead to the next 12 months, the majority (63%) of freelancers expect that their day rates will increase. A further 23 per cent expect a decrease whilst 15 per cent expect no change.

SOC1 managerial and SOC3 associate professional and technical freelancers were more likely to expect an increase in day rates (75% and 64% respectively) than SOC2 professional freelancers (53%). SOC2 professional freelancers were also more likely to predict a further deterioration in day rates (33%) compared to SOC1 managerial and SOC3 associate professional and technical freelancers (11% and 20% respectively).

Overall, it is expected that over the next 12 months, day rates will increase by an average of 8.7 per cent which is largely driven by the fact that SOC1 managerial and SOC3 associate professional and technical freelancers expect an increase to their day rates of 19.4 and 9.4 per cent respectively. SOC2 professional freelancers, however, only anticipate an increase of 0.8 per cent in their day rates over the next 12 months.

Capacity Utilisation

Spare capacity has stagnated at 3.7 and remains the same as in Q1 2021, meaning that freelancers were working 72 per cent of the time. This could be attributed to the delay of ‘Freedom Day’ stalling any increases in work expected from the removal of lockdown restrictions.

This stagnation has been driven by increases in spare capacity for SOC2 professional and SOC3 associate professional and technical freelancers (from 3.2 and 3.7 in Q1 2021 to 3.4 and 3.9 this quarter respectively). SOC1 managerial freelancers, on the contrary, saw their spare capacity decrease from 4.4 in Q1 2021 to 3.8 this quarter.

Overall, despite the stagnation in freelancers’ spare capacity between Q1 2021 and Q2 2021, it remains lower than levels at the height of the pandemic and it is important to note that freelancers were still contending with lockdown restrictions at the time of the survey (June 2021). Capacity utilisation must be closely monitored over the coming quarters to assess whether, with day rates also falling, we risk returning to the concerning trend of freelancers working more for less that we saw prior to Q1 2021.

Quarterly Earnings

Freelancers’ average quarterly earnings have decreased by 10 per cent since Q1 2021 and now stand at £18,652 in Q2 2021. The £18,652 figure is lower than the same quarter in 2019 where average quarterly earnings were £20,480, but higher than the same quarter in 2020, at the outset of the pandemic, where average quarterly earnings were at a record low £15,709. The fact that quarterly earnings are now higher than in Q2 2020 (£15,709) suggests that the easing of some restrictions has benefited freelancers but the fact that it falls short of the same quarter in 2019 (£20,480) can be attributed to spare capacity remaining high and day rates falling.

Looking at the different SOC groups reveals that SOC2 professional freelancers saw the biggest decrease, with quarterly earnings falling from £27,003 to £22,664 this quarter whilst SOC1 managerial freelancers also saw a drop, decreasing from £24,404 in Q1 2021 to £21,150 in Q2 2021.

SOC3 associate professional and technical freelancers, however, experienced a small rise in quarterly earnings from £12,736 in Q1 2021 to £13,368 this quarter, representing the highest quarterly earnings for this SOC group since Q4 2018.

With SOC1 managerial and SOC2 professional freelancers seeing decreases to quarterly earnings, it is interesting that confidence in the UK economy and in their own freelancer businesses has increased to, in some cases, record high levels and demonstrates the significance placed on the ending of restrictions for freelancers’ confidence.

Freelancers’ Business Costs

Looking ahead to the next 12 months, the majority (68%) of freelancers expect business costs to increase compared to 16 per cent who expect a decrease in costs and a further 16 per cent who expect no change.

Freelancers are forecasting an average increase of 11.1 per cent in business costs which is largely driven by SOC1 managerial and SOC2 professional freelancers expecting higher increases in input costs. This is an increase from last quarter, when freelancers were anticipating an increase of 7.4 per cent in business costs which indicates that freelancers are now expecting a larger increase in business costs over the next 12 months.

These increases in expected input costs are likely linked to the changes to IR35 rules which are forcing more contractors through umbrella companies. The increases could also be due to the cost of Coronavirus compliance checks associated with the easing of restrictions and the increased documentation and border checks between the UK and the EU since Brexit.

SOC1 managerial freelancers anticipate an increase of 13.3 per cent and SOC2 professional freelancers expect an increase of 12.5 per cent whilst SOC3 associate professional and technical freelancers, less likely to be affected by the IR35 changes forcing contractors to engage via umbrella companies, expect a smaller increase of 8.5 per cent.

Overall, freelancers are expecting an increase in business costs that would significantly exceed the current inflation rate (2.5%).

Business debt

More than one in three (38%) freelancers are now incurring business debt in Q2 2021, a significant increase on the 27 per cent incurring business debt in Q1 2021. In particular, the proportion of freelancers accruing debt via business loans from a friend/family member has increased from two per cent in Q1 2021 to five per cent in Q2 2021 and the proportion with loans from other businesses has increased from zero per cent in Q1 2021 to three per cent in Q2 2021.

Although the number of freelancers with credit cards issued in the name of their self-employed businesses has decreased from 16 per cent in Q1 2021 to 13 per cent in Q2 2021, those with business loans from commercial banks remains considerably higher than pre-pandemic levels (10% in Q2 2021 compared to 4% in Q1 2020).

Overall, there has been a significant increase in the percentage of freelancers now incurring business debt, representing the highest level since we started tracking business debt as part of the Confidence Index in 2019.

Job-related stress

We already know that the pandemic has had a devastating impact on freelancers’ stress levels, with previous research showing that freelancers were feeling more stressed and had higher concerns around issues such as cashflow and the availability of work as a result of the pandemic.2

Looking at this quarter, job-related stress levels have now fallen from 5.77 in Q1 2021 to 5.58 this quarter (on a 10-point scale where 0 is not at all stressed and 10 is extremely stressed) and continues the downward trend we’ve seen since a peak of 6.63 in Q1 2020.

This decrease is largely driven by lower job-related stress levels reported by SOC1 managerial (from 6.72 in Q1 2021 to 5.88 this quarter) and SOC2 professional freelancers (from 5.77 in Q1 2021 to 5.35 this quarter).

SOC3 associate professional and technical freelancers, however, experienced an increase in job-related stress levels, rising from 5.19 in Q1 2021 to 5.61 this quarter.

Job satisfaction

Job satisfaction remains similar to the previous quarter with an average socre of 5.88 in Q1 2021 and 5.85 in Q2 2021 (on a 10-point scale where 0 is not at all satisfied and 10 is extremely satisfied).

SOC3 associate professional and technical freelancers saw the biggest decrease, falling from 6.38 in Q1 2021 to 6.16 this quarter whilst SOC1 managerial freelancers also experienced a small drop from 5.58 in Q1 2021 to 5.37 in Q2 2021.

SOC2 professional freelancers, however, experienced a small increase in job satisfaction, jumping from 5.69 in Q1 2021 to 5.84 in Q2 2021.

Overall, job satisfaction has remained stagnant and the average job satisfaction rating of 5.85 for Q2 2021 remains short of the pre-pandemic levels of 6.03 and 6.14 for Q3 and Q4 2019 respectively. The stagnation in job satisfaction could be attributed to the delay in the easing of restrictions, with job satisfaction perhaps set to increase in Q3 2021 after ‘Freedom Day’ on 19 July.

Conclusion

As the economy opens up and kicks into gear again, freelancer confidence seems to be surging. Freelancers’ earnings are not yet matching these expectations, however – and the biggest factor in this seems to be more freelancers competing for fewer contracts after the changes to IR35. But the fact that freelancer confidence is surging is optimistic for the economy and the sector – even if the circumstances have not yet caught up.

The freelance sector is clearly raring to go, but is materially held up by the impact of the IR35 changes working through the contracting market. This may indicate an opportunity for government to boost the freelancing sector and thereby aid the economic recovery effort: by clearing the uncertainty and confusion left by the changes to IR35.

Latest news & opinions

IPSE welcomes the appointment of Emma Jones OBE as the new Small Business Commissioner, calling on government to equip the role with increased powers to tackle la...

IPSE’s Joshua Toovey explains what the recent announcement of planned changes to Companies House reporting means for company directors.

In this secret contractor blog, an anonymous IPSE member shares their verdict on how much more you should charge for working inside IR35.